Summary

- Thomas Fahrer predicts BTC could reach the half-a-million-dollar mark in the next 4 years.

- Potential triggers include BTC overtaking gold’s market cap and the US dollar being backed by BTC.

Despite intense market volatility, Bitcoin remains surrounded by optimistic predictions. The latest ones come from the CEO of crypto-focused reviews portal Apollo, Thomas Fahrer.

He recently addressed a couple of factors that could send the price of BTC over eight times its current value, addressing the conditions in which the coin could enter a “really strong bull market.”

In a recent interview he predicted that even if just a couple of events occur, BTC could race anywhere between $300,000 and $500,000 within the next four-year cycle.

2 Price Triggers for Bitcoin

The two factors that Fahrer mentioned are Bitcoin’s potential to overtake gold’s market cap sometime in the future and the US dollar becoming backed by BTC.

He highlighted that Bitcoin has a $1.2 trillion dollar market cap, while gold has a market cap of around $15 trillion. According to him, it’s an achievable outcome for Bitcoin to overtake the market cap of gold sometime during the next years.

Also, he mentioned that the US presidential candidate Robert Kennedy Jr. wants to back the US dollar with Bitcoin.

However, he doesn’t think that Kennedy will win, but he still believes that it’s an important fact that a Presidential candidate is pushing such an idea to the public.

Fahrer said that in a world in which the US dollar could become backed by Bitcoin, this would send the price of the digital asset “astronomically higher.”

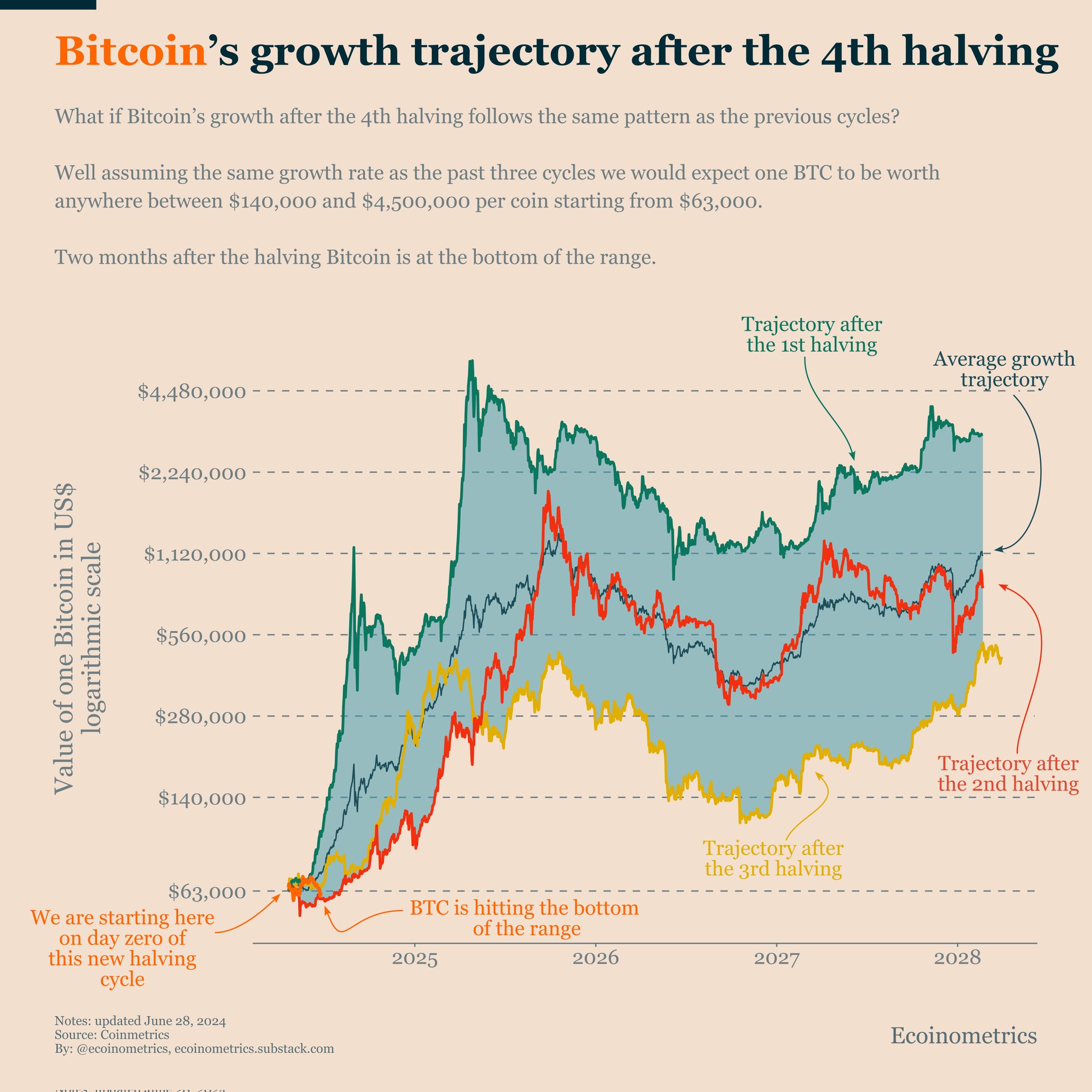

Bitcoin’s Growth Trajectory Post the 4th Halving

On July 2, Fahrer shared a post via his X account, noting that Bitcoin’s growth after the fourth halving might follow the same pattern as the previous cycles.

He addressed who might be selling BTC after the latest halving which took place on April 20 this year, and concluded that it might just be the governments and miners at this point.

Regarding Bitcoin’s price trajectory, he believes that assuming the same growth rate as the past three cycles, we could expect one BTC to be worth anywhere between $140,000 and $4.5 million per coin starting from $63,000, according to his graph.

Rising Interest in Bitcoin ETFs

Fahrer also mentioned the rising interest in Bitcoin ETFs in 2024, saying that his number of followers has been going up on X, since he started explaining updates on ETF inflows and outflows.

He highlighted the rising interest in the crypto products and today, he posted via his X account that BlackRock bought another 224 BTC, “even on the quiet days, chewing through half the mining supply.”

He also shared a graph revealing the total BlackRock Bitcoin ETF IBIT flows since its inception.

According to the latest data from SoSoValue, BlackRock has a total net assets in their BTC ETF of over $19 billion.

At the moment of writing this article, BTC is trading close to $61,000, after reaching prices above $63,000 on July 1.

- Zoom

- Type

A relief rally for the coin is expected to begin this month, according to recent data from CoinGlass based on historical price moves tracked since 2013.