Summary

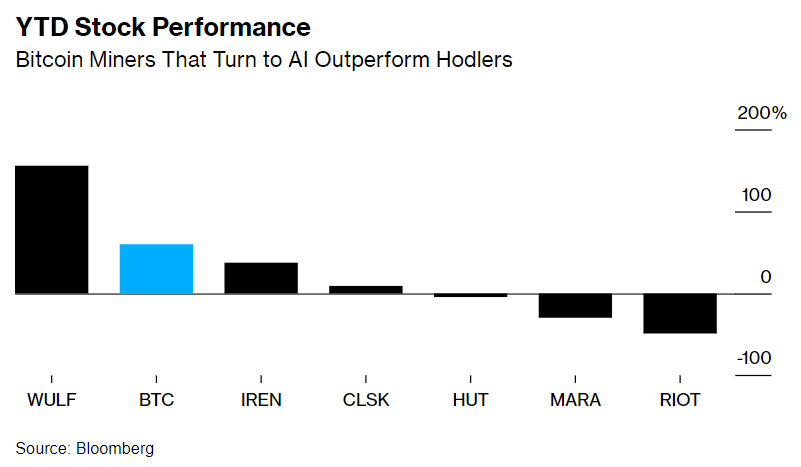

- Six months after the Bitcoin halving, miners embracing AI saw the biggest gains.

- Core Scientific and TeraWulf are among the top winners.

- However, pure-play miners such as MARA generate increased economic value as well.

According to the latest reports revealed by Bloomberg, since the Bitcoin halving which took place this year on April 20, the crypto mining industry saw a bifurcation: miners who have been betting solely on BTC price appreciation, have lagged behind the ones who chose to embrace AI.

2 Divergent Paths to Remain Viable in Crypto Mining

Bloomberg mentioned that public miners such as MARA Holdings, Riot Platforms, and CleanSpark keep the BTC they produce with the expectation that the coin’s price will surge in value.

Also, there is an increasing number of companies that are spending more on developing data centers that power AI applications.

This industry bifurcation has intensified especially after the April halving event which saw the Bitcoin miners’ rewards slashed from 6.25 BTC to 3.125 BTC.

Bloomberg quoted Wolfie Zhao, an analyst at research firm TheMinerMag, who said that the halving significantly squeezed profit margins, and one of the few strategies available to retain investors is that miners keep onto the BTC that they have mined, betting on future price appreciation.

According to Zhao, by avoiding the immediate sale of BTC at a loss, they can keep potential losses unrealized and place themselves for gains during potential upcoming bull markets.

Bloomberg noted that the shares of most companies have underperformed BTC’s 60% rally in 2024. However, companies embracing AI saw the largest gains.

Traditional Miners Vs. AI-Embracing Companies

Bloomberg mentioned MARA and Riot, two of the largest publicly traded BTC miners who are both hodlers, and it seems that they have recorded drops in their shares of about 20% and 36% respectively in 2024.

On the other hand, Core Scientific (a company that emerged from bankruptcy in January) has seen its stocks almost quadruple this year, since they announced a few multibillion-dollar contracts with AI upstart CoreWeave.

The AI data centers host graphics processing units that can generate high-performance computing power for AI apps.

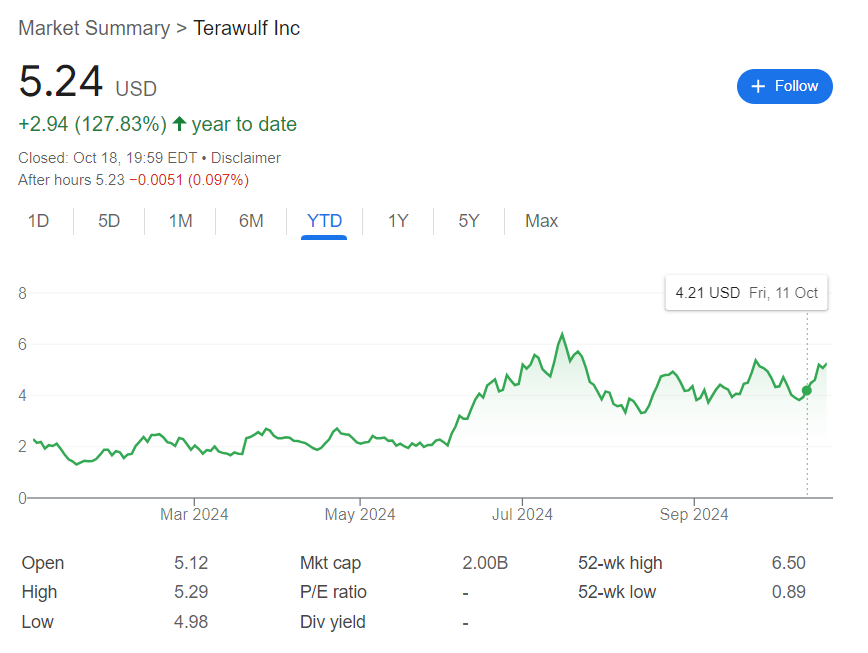

Another such example is TeraWulf which saw its stock doubling in 2024 – they have been developing AI data centers as well.

Bloomberg also noted other miners’ shares that have embraced AI including Iris Energy and Bit Digital, and now are seeing their shares above some of the companies that chose to hold the BTC they mine.

The Importance of Pure-Play BTC Miners

It’s also important to highlight that BTC miners who are betting on the future price surges of BTC and choosing to hold their coins have an important place in the market. These are also called “pure-play” BTC miners.

Paul Golding, senior analyst at Macquarie Capital USA, said these miners have an important place in the market, generating economic value from their growing capacity to mine BTC.

These companies, including Marathon Digital, are using their proceeds to buy and hold crypto, similar to the strategy adopted by MicroStrategy.

Considering the sustained BTC rally that kicked off at the beginning of this week, and the optimistic price predicitons, pure-play miners will see considerable gains as well.