Summary

- 3 triggers could lead to a Bitcoin supply crunch, meaning higher prices for the coin.

- BTC is trading above $62,000 today.

As history taught us, supply constraints can inflate prices for about anything and Bitcoin is no exception.

Here are three triggers that might lead to a supply crunch for BTC, meaning higher prices in the future.

3 Triggers Potentially Leading to Bitcoin Supply Crunch

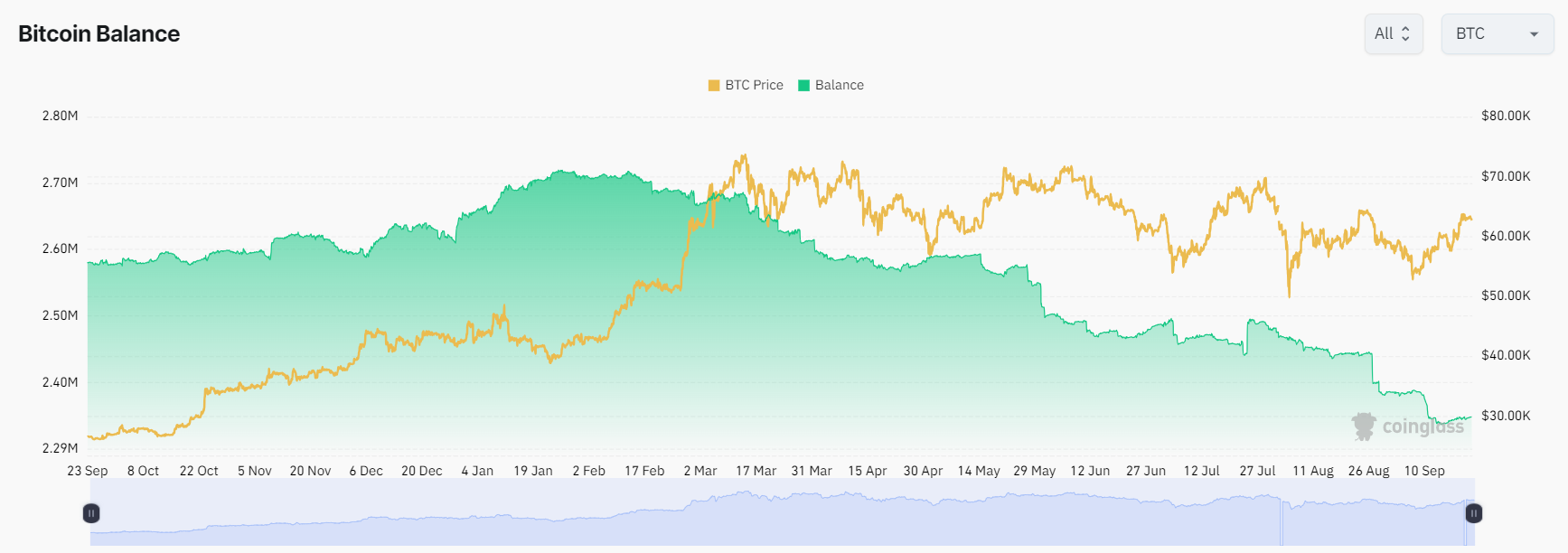

1. Bitcoin Balance on Exchanges At 12-Month Lows

According to the latest reports, Bitcoin’s balance on exchanges is at a 12-month low.

Data from CoinGlass notes that while BTC balance on exchanges peaked in January 2024 at around 2.7 million coins, now BTC balance is close to 30,000 coins on exchanges, its lowest level in 12 months.

Lower Bitcoin balance levels on exchanges are a positive sign, showing more commitment to hodling.

2. LTH Holders Are Reaccumulating

Founder of Wealth Mastery and Bitcoin and crypto investor Lark Davis explained in a post via X recently that Bitcoin supply held by long-term holders is rising again.

He shared data from Glassnode to highlight the idea, saying that LTHs took profits until Bitcoin’s ATH back in March, then they accumulated to the recent price dips.

While back in April 2024 the total supply of BTC held by long-term holders (LTHs) was around 13.4 million coins, now, in September 2024, the total amount of coins held by LTHs is over 14 million.

Long-term holders are wallets holding Bitcoin for more than 155 days.

The new Bitcoin buying spree of LTHs is another hint at a potential supply crunch incoming for BTC.

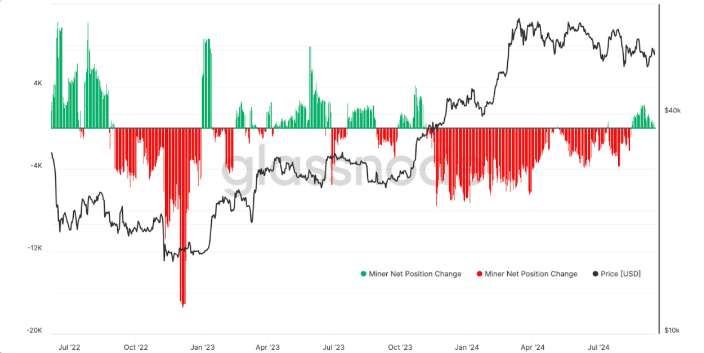

3. Miners Are Hoarding BTC

According to official data from Glassnode, Bitcoin miners are starting to hoard their BTC for the first time in about a year.

The number of miners holding their coins is on the rise following a longer period of capitulation this year.

The conclusion is that people have been buying and holding BTC in greater amounts recently, all this while Bitcoin’s supply on exchanges has been lowering – this means less Bitcoin availability. Increased demand and lower supply could trigger a price surge for BTC.

Bitcoin Trades Above $62,000

Regarding Bitcoin’s price today, at the moment of writing this article, BTC is priced above $62,000 down by almost 1% in the past 24 hours.

Although this week Bitcoin recorded increased volatility ahead of the US FOMC meeting, a significant price rally began following the 50 bps interest rate cut decision revealed on September 18.

The unexpected weekly jobless claims drop in the US also prompted a further price surge for the digital asset and BTC reached prices close to $64,000 on September 20.