Summary

- Despite analysts’ fears of a bear market, multiple factors are pushing Bitcoin’s price upwards.

- Today, BTC rebounded above $83,000 ahead of the FOMC meeting in the US.

Bitcoin shows signs of recovery ahead of today’s FOMC meeting, despite the fact that there are no predictions about a potential upcoming interest rate cut.

Crypto analysts have mixed views on BTC’s recovery odds, suggesting potential bear market risks amidst low demand and new wallets selling BTC.

However, today’s FOMC meeting could bring positive news regarding the Fed’s approach to US liquidity, an important issue in BItcoin’s future trajectory. Multiple factors suggest it’s worth maintaining optimism for the future.

Bitcoin Trades Above $83,000

At the moment of writing this article, BTC is trading above $83,000, seeing a rebound following a recent dip at $81,000 on March 18.

Despite recent volatility triggered by multiple factors including market uncertainty ahead of the US FOMC meeting, and a recent streak of outflows from BTC ETFs, multiple signs point to a future recovery in the Bitcoin and crypto market.

Analysts’ Mixed Views on Bitcoin Recovery

On March 18, CryptoQuant’s CEO, Ki Young Ju, shared a post on X, saying that the Bitcoin bull cycle is over and he’s expecting between 6 to 12 months of bearish price action.

He cited reasons including the following:

- Fresh liquidity drying up and new whales are selling BTC at lower prices.

- BTC ETFs have been seeing continued negative inflows recently.

Bitfixex has also recently addressed the recent outflows from BTC ETFs, suggesting that institutional buyers have not yet returned with enough strength to counteract selling pressure.

Meanwhile, other analysts have more optimistic views about the market’s future.

For instance, Charles Edwards, co-founder of crypto VC Capriole Investments, believes that Bitcoin could bounce back, saying that the US might have already seen a potential bottom in liquidity.

In a post on X, he highlighted that it’s been almost 4 years since the tightening began in the US and 2025 could bring a change in monetary policy.

Also, Coinbase analysts have an optimistic view about BTC’s trajectory, saying that the Fed could finally pause the quantitative tightening (QT) approach. This is the Fed’s approach to cap the US liquidity and it’s the opposite of quantitative easing (QE).

Increased US liquidity translates into more capital flowing into the crypto industry pushing more inflows in BTC ETFs and eventually taking BTC prices higher.

These are some important factors that could be addressed during today’s FOMC meeting.

Why to Maintain Optimism on Bitcoin’s Trajectory

First of all, despite recent Bitcoin ETFs’ streak of outflows, the crypto products have recorded their third day of inflows on March 18, with over $209 million, showing renewed institutional interest, despite the recent break.

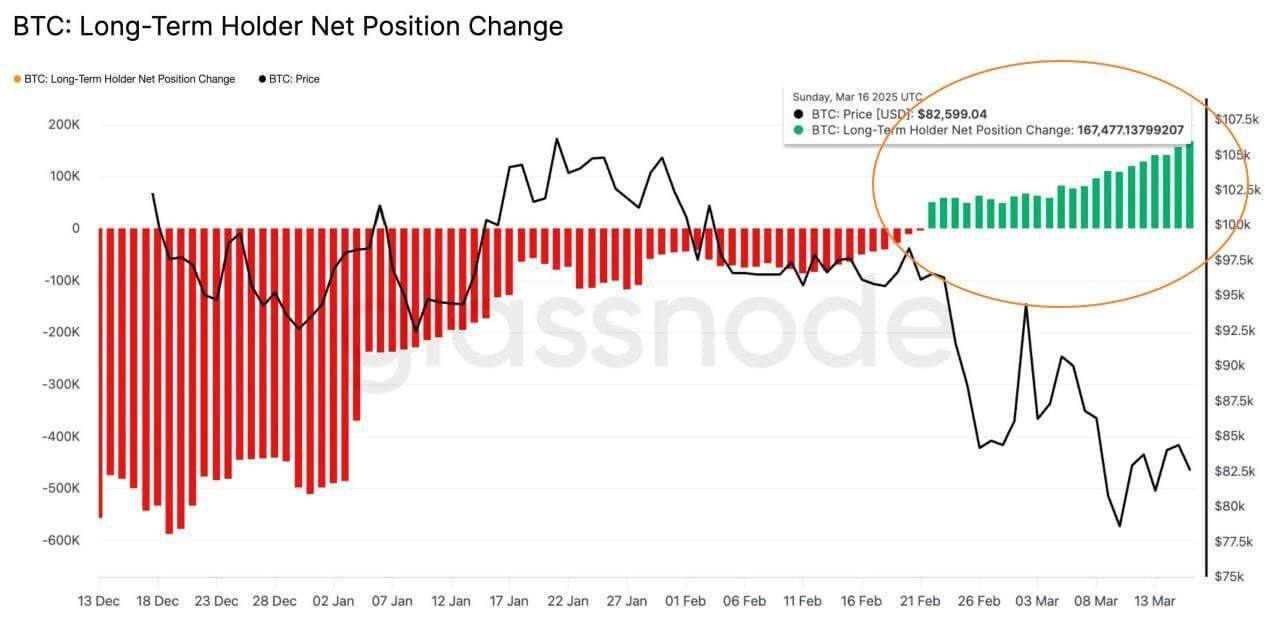

Also, despite new whales selling BTC at lower prices, as CryptoQuant said, long-term holders (LTHs) are actively accumulating BTC, adding more than 167,000 BTC in the past month, as Glassnode data shows.

And, regarding the fears of low liquidity in the US, today the Fed could decide on reversing its QT stance and have a more QE-based approach after four years if the markets show a more optimistic economic state.

Last week, the CPI report showed an eased inflation which is a good sign for the economy.

Despite the fact that there are no expectations for an interest rate cut today, according to predicitons from CME Group, plenty of reasons suggest a recovery in the Bitcoin and crypto market.

Today’s FOMC meeting will hopefully signal a sentiment shift and bring higher US liquidity that will end up pumping the crypto markets.

Besides all these factors, Bitcoin is surrounded by optimism due to increased global adoption, Trump’s crypto-friendly approach, and the upcoming codification into law of his Executive Order about establishing a Strategic BTC Reserve and a Crypto Stockpile.