Summary

- US Bitcoin ETFs recorded $39 million in inflows on August 13.

- Goldman Sachs recently disclosed $418 million in BTC ETFs.

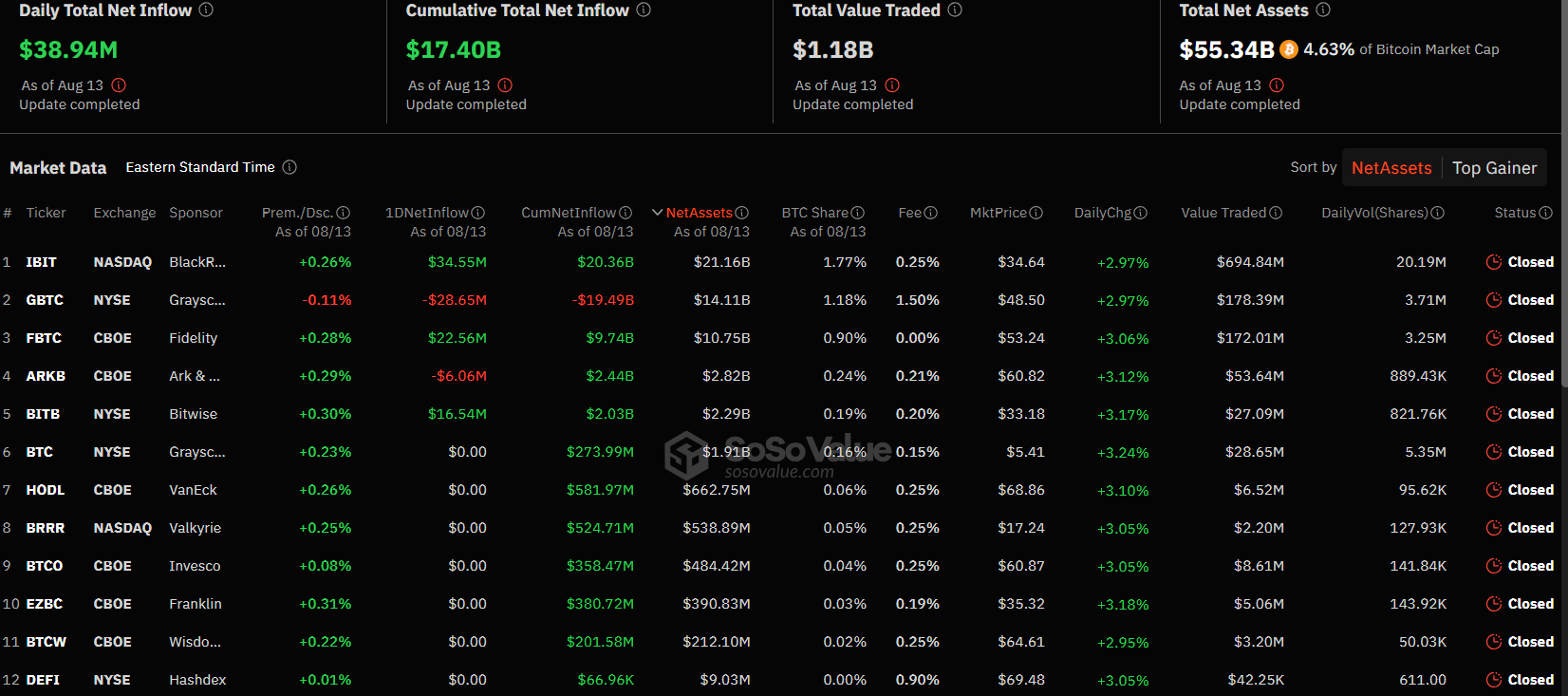

According to the latest reports from SoSoValue, the US-based Bitcoin ETFs recorded $39 million in inflows on August 13.

BlackRock’s Bitcoin ETF, IBIT, saw inflows of $34.5 million the other day, and the total net assets in their crypto product are now $21.1 billion.

Fidelity’s Bitcoin ETF, FBTC, recorded $22.5 million on August 13, and the crypto product has $14.1 billion net assets locked.

Bitwise’s Bitcoin ETF, BITB, saw $16.5 million in inflows the other day, and the US-based crypto product now has a total net assets of $1.9 billion locked.

Ark Invest 21Shares’ Bitcoin ETF, ARKB was the only crypto product that saw outflows totaling $6.06 million on August 13. The other US Bitcoin ETFs did not see any inflows or outflows the other day, according to official data from SoSoValue.

Institutional Investments in Bitcoin ETFs

Institutions are pouring their money into the US-based Bitcoin ETFs. For instance, Goldman Sachs just disclosed fund shares in BTC ETFs worth over $418 million as of June 30.

The company filed a 13F with the US SEC on August 13, as institutional investment managers with more than $100 million in equity assets under management must submit such filings on a quarterly basis.

Of the $418 million in Bitcoin ETFs, Goldman Sachs has $238.6 million in BlackRock’s Bitcoin ETF, IBIT, totaling almost 7 million shares.

In a post on X, MacroScope revealed the exact numbers of all the company’s positions in the US-based crypto products:

After the market closed today, Goldman Sachs filed a 13F disclosing the following positions as of June 30:

$238.6 million iShares Bitcoin Trust (6,991,248 shares)

$79.5 million Fidelity Bitcoin ETF (1,516,302 shares)

$35.1 million Grayscale BTC (660,183 shares)

$56.1 million…— MacroScope (@MacroScope17) August 13, 2024

Speaking of institutional investments in the US Bitcoin ETFs, it is also worth mentioning the fact that Europe’s 4th largest hedge fund Capula Management, based in London, also recently invested in BlackRock and Fidelity’s Bitcoin ETFs.

The firm disclosed around $500 million in these crypto products.

Large financial entities’ investments are relevant due to their strong influence on market sentiment and trends.

Bitcoin Price Near $61,000

Regarding the price of Bitcoin today, at the moment of writing this article, BTC is trading close to $61,000, up by more than 3% today.

The coin marked an important price recovery following the August 5 decline in prices in both equities and the crypto market.

This week is filled with important macroeconomic events that might trigger volatility for Bitcoin.