Summary

- Bitcoin ETFs continue their inflow streak with almost $85 million on July 18.

- BlackRock’s IBIT recorded $102.6 million in inflows the other day.

- Bitcoin’s price could see a breakout in September.

Despite intense market volatility, the US-based Bitcoin ETFs continue seeing inflows for 10 consecutive days.

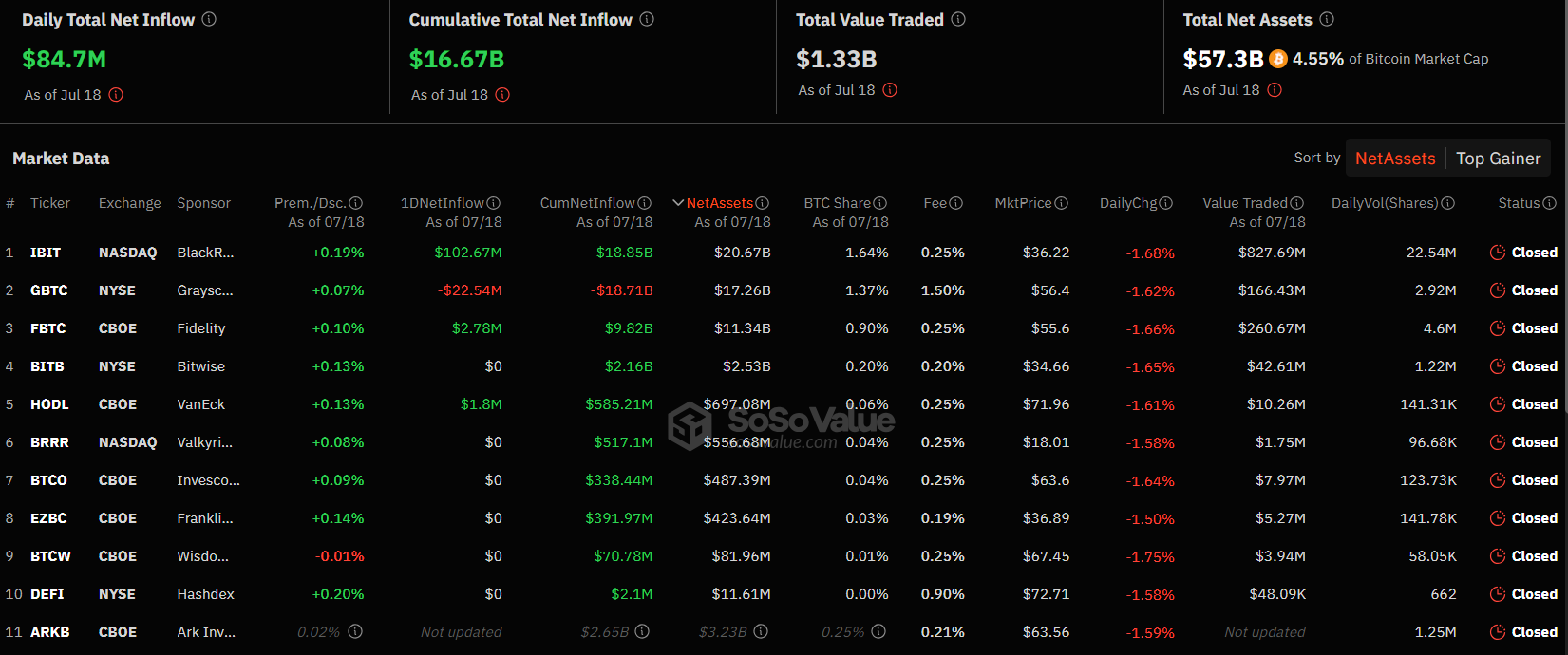

Yesterday, on July 18, the crypto products recorded almost $85 million in inflows, according to official data from SoSoValue.

BlackRock’s Bitcoin ETF, IBIT, recorded $102.6 million in inflows the other day, while Fidelity’s Bitcoin ETF, FBTC, saw $2.7 million in inflows.

VanEck’s Bitcoin ETF, HODL, saw $1.8 million in inflows, as Grayscale’s Bitcoin ETF, GBTC, recorded $22.5 million in outflows the other day.

The other Bitcoin ETFs did not see any inflows or outflows on July 18, according to the same data.

The total net assets in Bitcoin ETFs are $57.3 billion, SoSoValue data notes.

BlackRock’s IBIT Investors Continue Buying Spree

BlackRock’s Bitcoin ETF, IBIT, investors continue the buying spree, despite the recent price volatility of Bitcoin.

Co-founder of crypto data platform Apollo, Thomas Fahrer, shared a post via his X account, highlighting BlackRock’s recent moves.

Today, he shared a message saying that BlackRock has purchased over $1 billion worth of Bitcoin this month and this is a total acceleration of inflows.

Regarding Bitcoin’s price today, at the moment of writing this article, BTC is trading above $64,000, down by almost 1% for the day.

The coin reached prices over the important mark of $66,000 on July 17.

Bitcoin Breakout From the Re-accumulation Range

Popular crypto trader and analyst known as Rekt Capital on X shared a post regarding a potential Bitcoin breakout that should take place this year according to his notes.

A few hours ago, he shared a message on the social media platform revealing that if history were to repeat itself, a Bitcoin breakout from the re-accumulation range could occur in September 2024.

He also shared a graph comparing the price trajectory of BTC in 2024 to the one in 2020.

On July 18, we also reported that an important Bitcoin metric turned bullish, bringing more optimism to the crypto market.