Summary

- Bitcoin ETFs recover with $192.5 million in inflows.

- BTC is trading above $60,000.

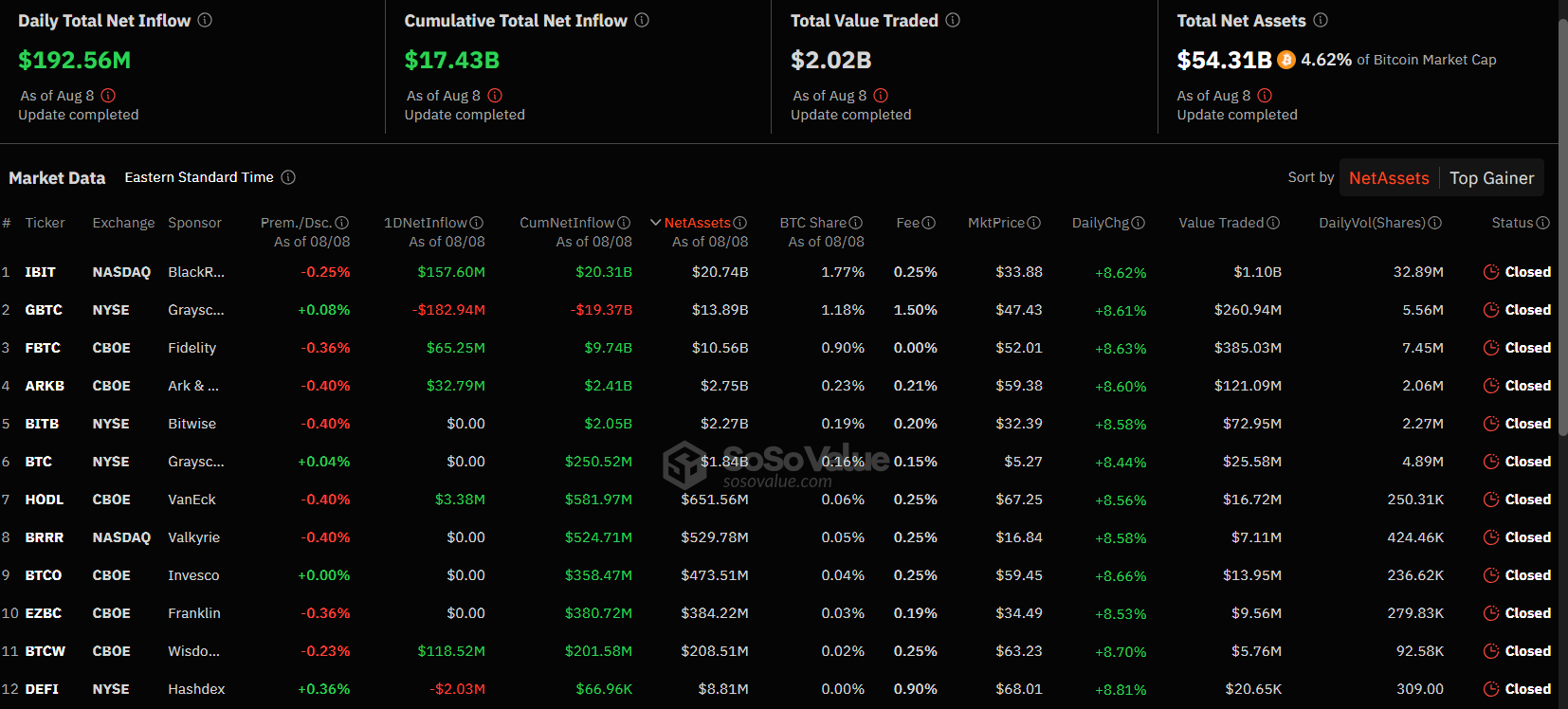

According to the latest official reports, Bitcoin ETFs recorded $192.5 million in inflows on August 8 after a few weaker days of less significant influxes.

Here are the inflows and outflows in the US-based crypto products, with BlackRock leading the way:

- BlackRock’s Bitcoin ETF, IBIT, recorded $157.6 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, saw $65.2 million in inflows.

- Ark and 21Shares’ Bitcoin ETF, ARKB, saw $32.79 million in inflows.

- VanEck’s Bitcoin ETF, HODL, recorded $3.38 million in inflows.

- WisdomTree’s Bitcoin ETF, BTCW, recorded $118.5 million in inflows.

- Grayscale’s Bitcoin ETF, GBTC, saw almost $183 million in outflows.

The other Bitcoin ETFs in the US did not see any inflows or outflows the other day, according to official data from SoSoValue.

The same data reveals that the total net assets in the US Bitcoin ETFs are $54.3 billion as of August 8.

Bitcoin Trades Above $60,000

Regarding Bitcoin’s price today, at the moment of writing this article, the digital asset is trading above $60,000, up by over 6% in the past 24 hours. Earlier today, the coin reached levels above the important mark of $62,000.

BTC began this week by dipping below the important level of $50,000, along with the decline in the crypto and equities markets. But the crypto was able to bounce back quickly.

Recently, Grayscale Research also addressed Bitcoin’s remarkable recovery in price. In recent market research, Grayscale addressed the one most important condition under which the digital asset could re-test its ATH in 2024.

According to them, if the US economy remains on a path to a soft landing and if the country can avoid a recession, then we can see BTC’s price retesting its ATH (prices near $74,000) this year.

However, they also noted that even in a weaker economic environment, the downside risks to prices may be more limited compared to past drops.