Summary

- Bitcoin ETFs saw $295 million in inflows on July 8.

- This is the highest net inflow in the past 21 days.

- BTC is trading above $57,000.

Following a sluggish period, Bitcoin ETFs recorded $295 million in inflows on July 8, representing the highest net inflow in the past 21 days.

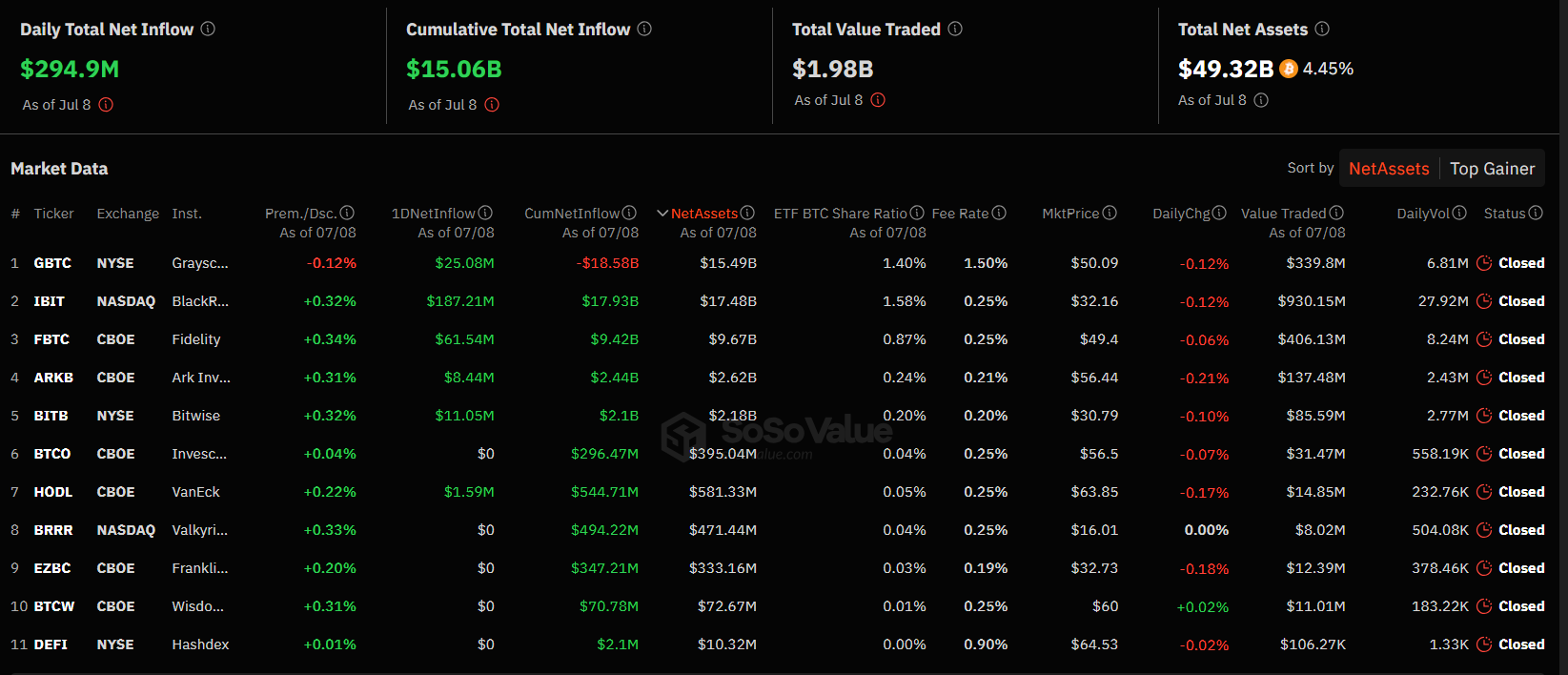

According to the latest reports from SoSoValue, the net inflows in BTC ETFs on July 8 were the following:

- Grayscale’s Bitcoin ETF, GBTC recorded $25 million in inflows.

- BlackRock’s Bitcoin ETF, IBIT, recorded $187.2 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, saw $61.5 million in inflows.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, recorded $8.44 million in inflows.

- Bitwise’s Bitcoin ETF, BITB, saw $11 million in inflows.

- VanEck’s Bitcoin ETF, HODL, saw $1.6 million in inflows.

The other Bitcoin ETFs did not record any inflows or outflows the other day, based on the same official data.

The total net assets in BTC ETFs as of July 8 were over $49 billion.

Earlier, Binance’s CEO, Richard Teng, noted in a message on X, that in 6 months, the US-listed BTC ETFs brought in more than $14 billion in net inflows.

According to him, the key takeaway is that interest in Bitcoin and digital assets remains high and, even if the token prices and market caps fluctuate, the long-term fundamentals of the industry are strong.

In 6 months, US-listed Bitcoin ETFs brought in over $14.7B in net inflows. Key takeaway? Interest in #Bitcoin and digital assets remains high.

Token prices and market caps fluctuate, but the long-term fundamentals of our industry is strong.

Stay focused and keep building! 🚀

— Richard Teng (@_RichardTeng) July 9, 2024

Bitcoin Above $57k

At the moment of writing this article, BTC is trading above $57,000. The coin is up by more than 3% in the past 24 days, following recent price dips around $55,000 levels.

- Zoom

- Type

Bitcoin’s price drops have been triggered by more factors including the fears around Mt. Gox repayment to creditors, the German Government selling significant amounts of BTC, and the massive market liquidations.

The other day, according to official data, the German Government sold the largest amount of BTC in recent times, totaling the amount of $915.3 million.

According to data from Coinglass, the total BTC liquidations in the past 24 hours were almost $100 million. Of these, almost $48 million were in long BTC and almost $52 million were in short BTC.

The crypto market saw liquidations of over $242 million in the past 24 hours according to the same data.

Recent reports coming from Bloomberg detailed that BTC started the week under pressure due to new concerns about potential sales of coins by creditors of the Mt. Gox exchange.

The long-awaited fund return of the exchange has reportedly put the focus on a potential wall of supply coming into the crypto market.