Summary

- Bitcoin ETFs recorded $79 million in inflows on July 11.

- BTC records the second-largest institutional accumulating process of the year.

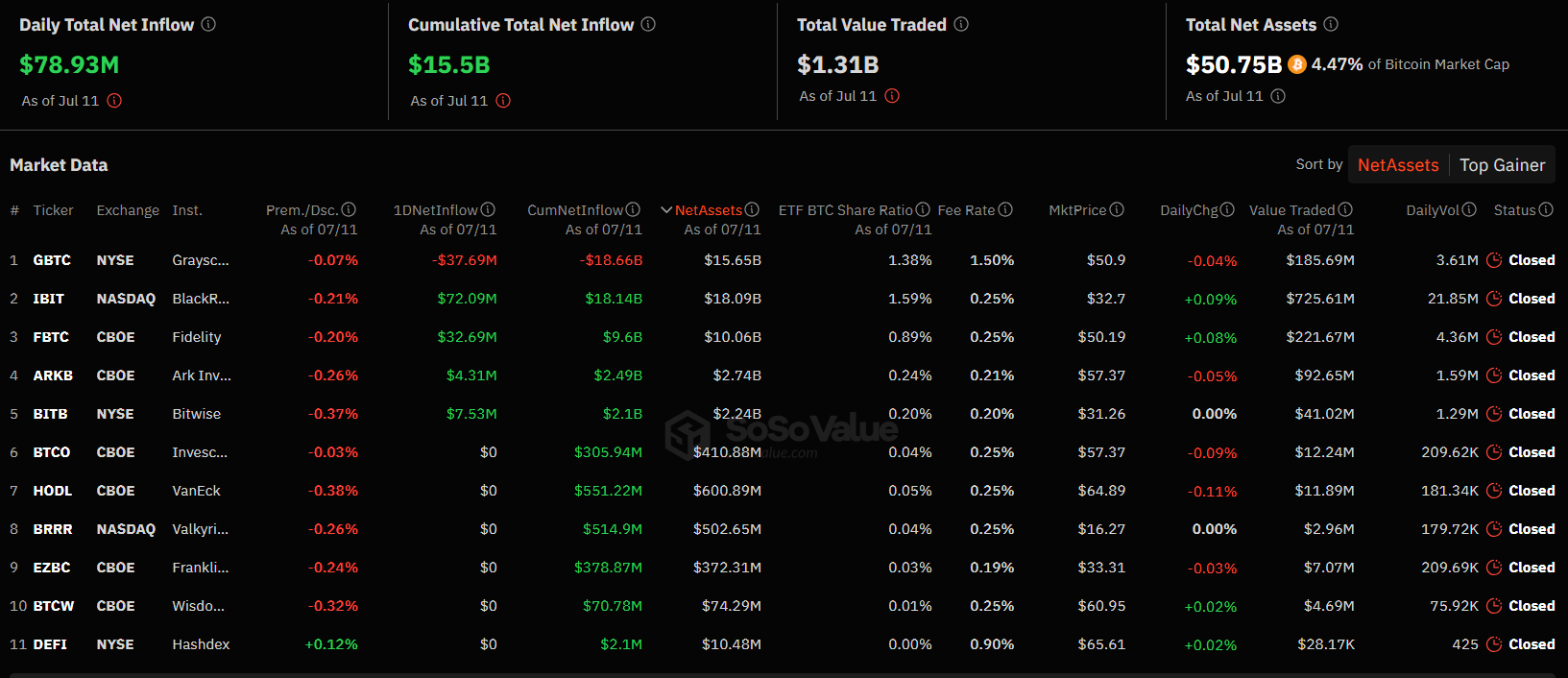

Bitcoin ETFs recorded total net inflows of $79 million on July 11, marking the 5th consecutive day of influxes in the crypto products.

According to the latest reports from SoSoValue, the total net assets in BTC ETFs in the US are $50.7 billion as of July 11.

Here are the inflows and outflows in the crypto products from the other day:

- BlackRock’s Bitcoin ETF, IBIT, recorded $72 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, saw $32.6 million in inflows.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, recorded $4.3 million in inflows.

- Bitwise’s Bitcoin ETF, BITB, recorded $7.5 million in inflows.

Grayscale’s Bitcoin ETF, GBTC, saw outflows of over $37 million on July 11, while the other BTC ETFs in the US did not record any inflows or outflows the other day.

The trading volume in spot Bitcoin ETFs in the US remains significantly lower than in March when the volume exceeded $8 billion in a few days. The ETFs have accumulated a total net inflow of $15.5 billion since their launch in January of this year.

2nd Largest Institutional Accumulation Process of 2024

According to recent reports shared by CryptoQuant, Bitcoin saw the second-largest institutional accumulation process of this year.

While a lot of novice investors capitulated last week, with a special emphasis on coins bought between 1 and 3 months ago, institutional players made the largest accumulation process since March.

The first months of the launch of Bitcoin ETFs were marked by an intense process of accumulation by institutional players. However, it’s worth noting that a large part of this accumulation was the funds issuing the ETFs themselves, according to reports.

Also, last week, an accumulation process of over 101,000 BTC was recorded, but with a significant detail to be noted: low volume of fundraising in ETFs and falling prices.

In other words, unlike the process of accumulation seen in March, which was a demand more linked to fundraising, the current institutional accumulation could indicate a true process of buying the dip.

Also, the other day, we reported that July has seen an increase of 261 new wallets that are now holding over 10 BTC.