Summary

- 74% of all circulating Bitcoin remained dormant for over 6 months.

- This strong holding behavior mirrors belief in Bitcoin’s long-term value.

According to the latest reports, about 74% of all the Bitcoin in circulation has not been moved over the past six months.

On-chain data from Glassnode the HODL Waves chart uses blockchain data to offer a macro view of Bitcoin held in wallets based on the time since it last moved.

According to the data, 74% of BTC has been stationary for most of 2024, despite the intense market volatility.

The HODL Waves chart is a tool that visualizes the age of Bitcoins based on when they last moved, and it shows the ways in which various groups of holders react to market conditions.

The dominance of older coins meaning the coins that have been held in wallets for at least 6 months suggests that long-term investors are increasingly holding on to their BTC. This shows a potential anticipation of future price increases.

This holding trend is important because it shows a reduced supply of Bitcoin available for trading which could lead to increased price stability or price appreciation as the demand for new coins grows.

The data also highlights the contrast between short-term traders and long-term investors. Long-term investors are likely to hold their positions during periods of more intense market volatility.

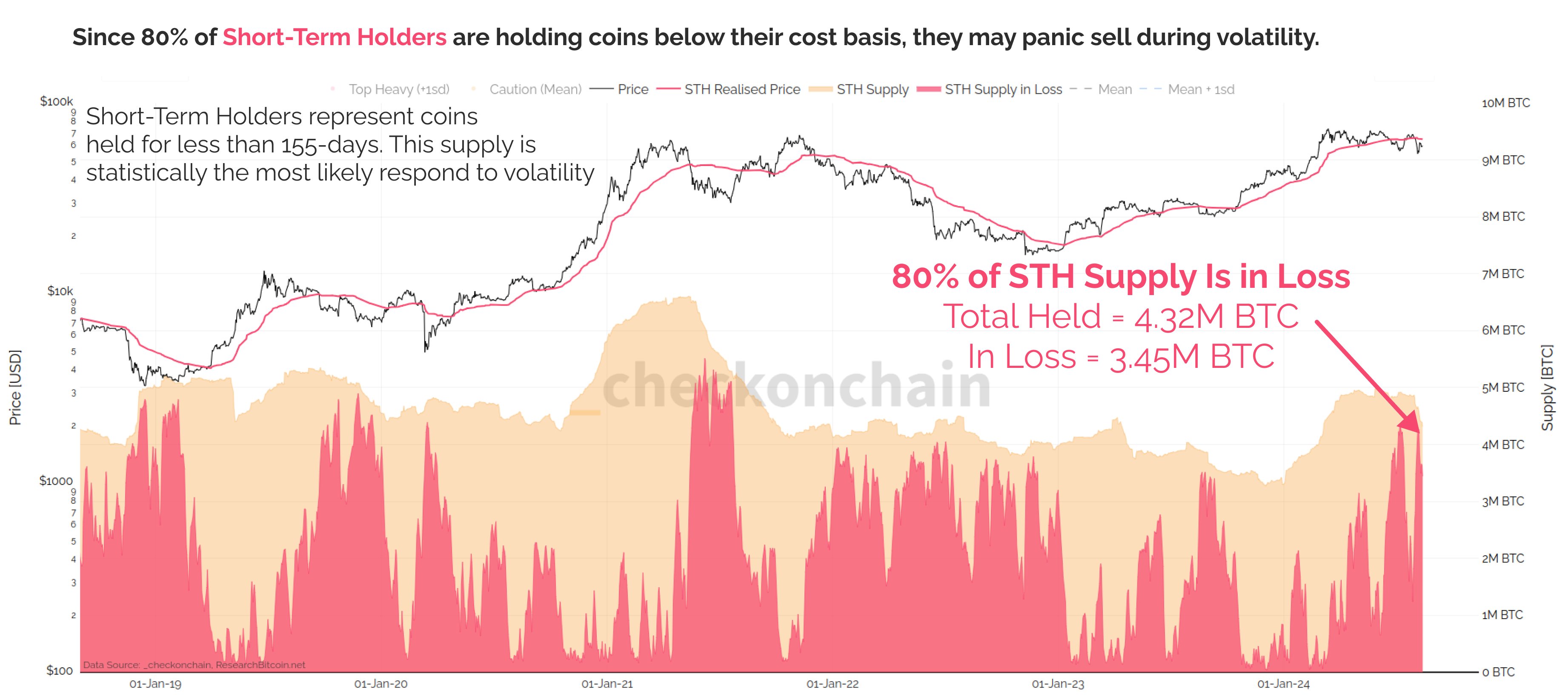

Over 80% of Bitcoin STHs Underwater

According to a post on X today, on-chain analyst James Check noted that more than 80% of Bitcoin short-term holders are underwater, which means that their coins were bought at a price above the current price spot.

He noted that this is similar to 2018, 2019, and mid-2021 which signaled many investors were at risk of panicking and precipitating a bearish trend.

Short-term holders are entities that have held BTC for less than 155 days.

Regarding Bitcoin‘s price today, at the moment of writing this article, BTC is trading above $58,000.