Key Points

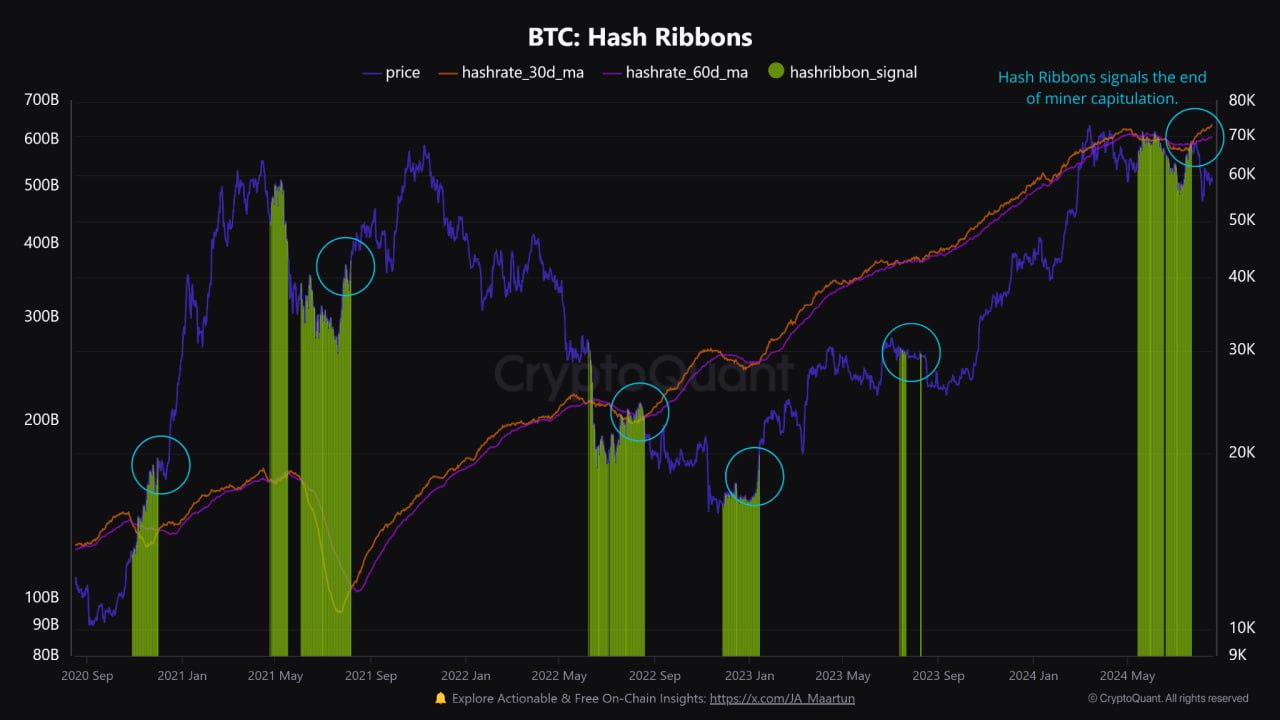

- Hash Ribbons metric signals the end of Bitcoin miner capitulation.

- BTC is now trading above $61,000.

According to the latest reports from CryptoQuant, an important Bitcoin metric is signaling the end of miner capitulation.

In a post on X, CryptoQuant, explains that Hash Ribbons is a popular market indicator that highlights periods of stress in the mining market. This uses the 30 and 60-day moving averages of the Hash Rate and has signaled the end of miner capitulation, according to the data.

It’s also important to note that the Hash Rate has just reached a new ATH of 638 EH/s. Miners are reportedly beginning to use more efficient equipment, turning their machines back on and becoming less likely to sell.

CryptoQuant also notes that this is the first time that this has happened since the halving event which took place back in April 2024, when the block reward for miners was reduced to 3.125 BTC, making it a significant and healthy signal.

CryptoQuant also writes that this indicator is not meant to pinpoint the exact price bottom, but it often proceeds higher prices by signaling a reduction in selling pressure for miners.

The end of miner capitulation as indicated by the Hash Ribbons suggests that the mining sector is stabilizing and miners are regaining confidence.

Another bullish sign for Bitcoin is the fact that an important metric remains lower than during previous ATH breaks.

The LTH Sell-Side Risk Ratio

As noted by Glassnode, the Long-Term Sell-Side Risk ratio remains lower than previous ATH breaks. This reportedly indicates that the LTH cohort is taking smaller profits compared to past cycles.

This suggests that the cohort may be waiting for higher prices before increasing selling pressure.

Also, one more potential bullish catalyst this week could be the Jackson Hole meeting scheduled on August 22.

Charles Edwards, founder of Capriole Fund notes that 70% of the time, markets are up for the week following the annual meeting.

Regarding Bitcoin‘s price today, at the moment of writing this article, BTC is trading above $61,000, up by over 4% in the past 24 hours.