Key Points

- Increased demand for Bitcoin signals market consolidation finale.

- BTC whales accumulated 94.7K more BTC in the last 6 weeks.

Increased demand for Bitcoin signals market consolidation finale, according to the latest reports.

In a new post on X, CryptoQuant author, Axel Adler, notes that after Bitcoin reached the $57,000 mark, there has been an increase in the average daily token transfer volume from $650,000 to $765,000.

This change reportedly coincides with Bitcoin’s price stabilization within the local consolidation range of $57,000-$68,000.

Market Reaction

According to his notes, the increase in transfer volume is mainly due to panic selling by holders. Despite this, Bitcoin’s price is currently showing resilience, suggesting that the market has absorbed the selling pressure without significant declines.

This consistent price range during the increase in transfer volume shows stable demand for Bitcoin, suggesting the fact that investors are keen to buy the coin.

The increase in token transfer volume at $57,000 is an indicator of sustained demand, which points to a bullish outlook among many market participants.

According to Adler’s post, the market is approaching the final phase of consolidation, which usually involves narrowing price movements and decreased volatility.

Bitcoin Whales Accumulation

In a recent post on X, Santiment noted that Bitcoin whales especially wallets holdings between 100 and 1,000 BTC have accumulated 94,700 more BTC in the past 6 weeks.

As price uncertainty has shaken many traders out of the market, key stakeholders are now loading up according to the notes shared by Santiment.

Bitcoin Above $60,000

Regarding Bitcoin’s price today, at the moment of writing this article, BTC is trading above $60,000, up by over 4% today.

Earlier, the coin was trading above $61,300.

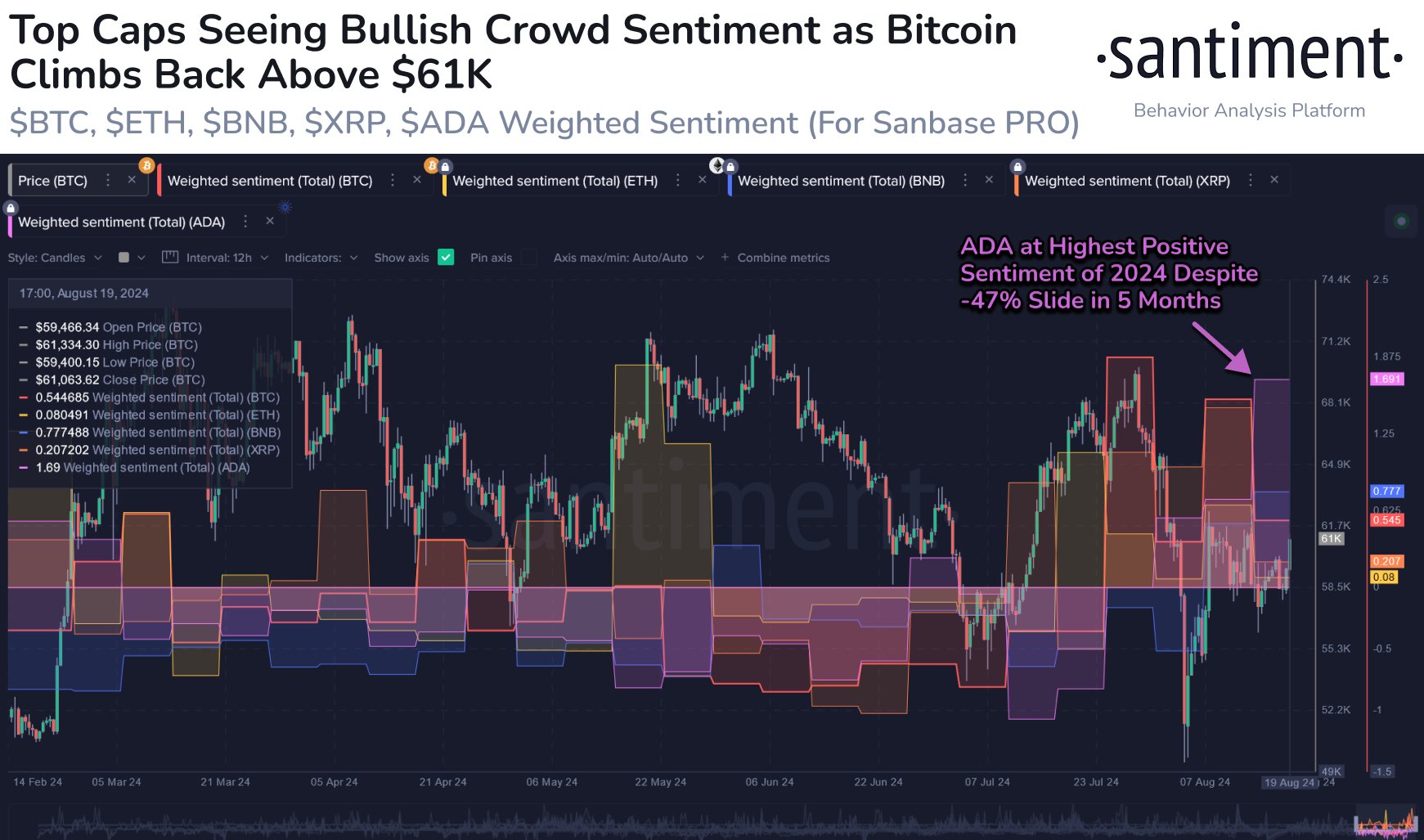

In another post on X today, Santiment notes that crypto is showing signs of recovery, with BTC rebounding above $61,300.

According to them, the crowd sentiment has been flipping more and more bullish for most top caps since August 5, with BTC during by more than 19% since the crash.

Also, earlier today, we reported that an important metric showed the end of Bitcoin miner capitulation, another bullish sign for the market.