Summary

- Bitcoin is trading above $65,000, despite Mt. Gox starting the repayment process to creditors.

- CryptoQuant founder believes the Mt. Gox FUD is overestimated.

Bitcoin’s price is up by over 3% today, and the coin is now trading above $65,000. Important analysts believe that traders’ FUD triggered by Mt. Gox is overestimated and will not affect Bitcoin’s price significantly.

On July 16, the defunct crypto exchange Mt. Gox started the repayment process to creditors who had been affected by the massive 2014 hack.

Mt. Gox Sends BTC to Kraken

Yesterday, over 47,000 BTC was sent to Kraken, and according to the latest reports, creditors will receive the funds within 7-14 days.

CryptoQuant shared a notice from Kraken via X which states that the exchange has successfully received creditor funds in BTC and BCH from the Mt. Gox Trustee. According to the note, the amount that people will receive will be determined by the Trustee, and the funds will be distributed according to the instructions.

Mt. Gox FUD Is Overestimated

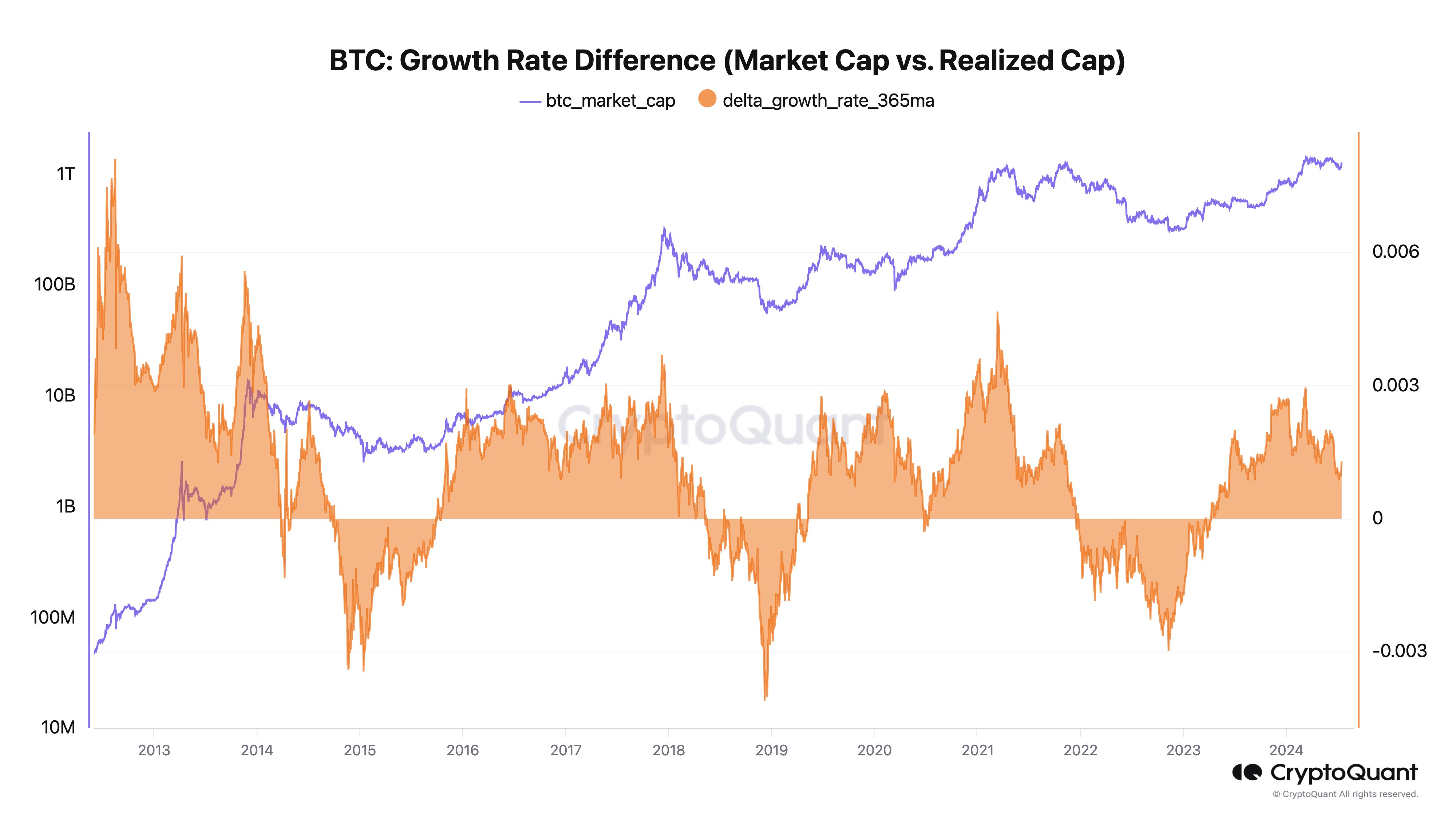

Recently, the CEO of CryptoQuant shared a post on X, explaining that the FUD around the fund distribution from Mt. Gox is overestimated and will not affect Bitcoin’s price significantly.

According to him, market cap growth is outpacing realized cap growth, showing strong demand. He said that since 2023, $224 billion in Bitcoin was sold, yet the price is still up by 350%.

On July 16 he said that even if Mt. Gox’s $3 billion is sold to Kraken, this is just 1% of the realized cap increase in this bull cycle, which is manageable liquidity.

However, he said that Bitcoin is still vulnerable to speculative FUDs, mentioning that while some traders were panic selling during the German government FUD, others were buying.

Mt. Gox’s Impact on Bitcoin Price

Mt. Gox began the repayment process to credits on July 16, and the full distribution process is expected to be a gradual one, with a deadline in place set by court order for October 2024.

The total amount of crypto involved in the process is significant, and Mt. Gox was estimated to hold around 140,000 BTC and a larger amount of BCH.

The exact impact on Bitcoin’s price is still uncertain, but it’s worth noting that some analysts believe that the distribution will be spread over time, mitigating any significant price impacts.