Summary

- BTC recorded a rebound in price today of over 3%.

- BTC ETFs continued their inflow streak on July 10, seeing $216 million in inflows.

Bitcoin recorded a surge in price today, July 10, following intense volatility. At the moment of writing this article, BTC is trading above $59,000, up by 3% today.

Despite the recent price fluctuations of BTC triggered by German Government sell-offs, and the fears surrounding Mt. Gox repayment to creditors, BTC remained surrounded by optimistic predictions.

Recently, CryptoQuant revealed an important market indicator that shows an opportunity that comes once within a bull cycle.

On-chain data shows the height of the miners’ profits, this being an indicator that’s generally good for finding the bottom of a bear market. It also reveals an anticipation for the end of a correction period within a bull market.

This indicator fell significantly during the bull cycle in 2016 and 2020, when the beginning of Bitcoin’s strong rise followed.

CryptoQuant cited data from popular investor Crypto Dan saying that Q3 2024 will mark the start of a new bull run for Bitcoin.

Market Overview of Current Bitcoin Demand and Supply

On July 9, Bitcoin on-chain analyst Willy Woo shared a post on X, revealing that the market overview of the current state of Bitcoin demand and supply includes the following:

- Miners

- German Government

- Bitcoin ETFs

- Futures

He also reiterated the importance of a climb in Bitcoin’s hash rate in order to resume new bullish moves for the coin.

Despite the recent price volatility for Bitcoin and numerous sell-offs, Bitcoin ETF issuers have been accumulating BTC during the past few days.

Bitcoin ETFs Continue Inflow Streak

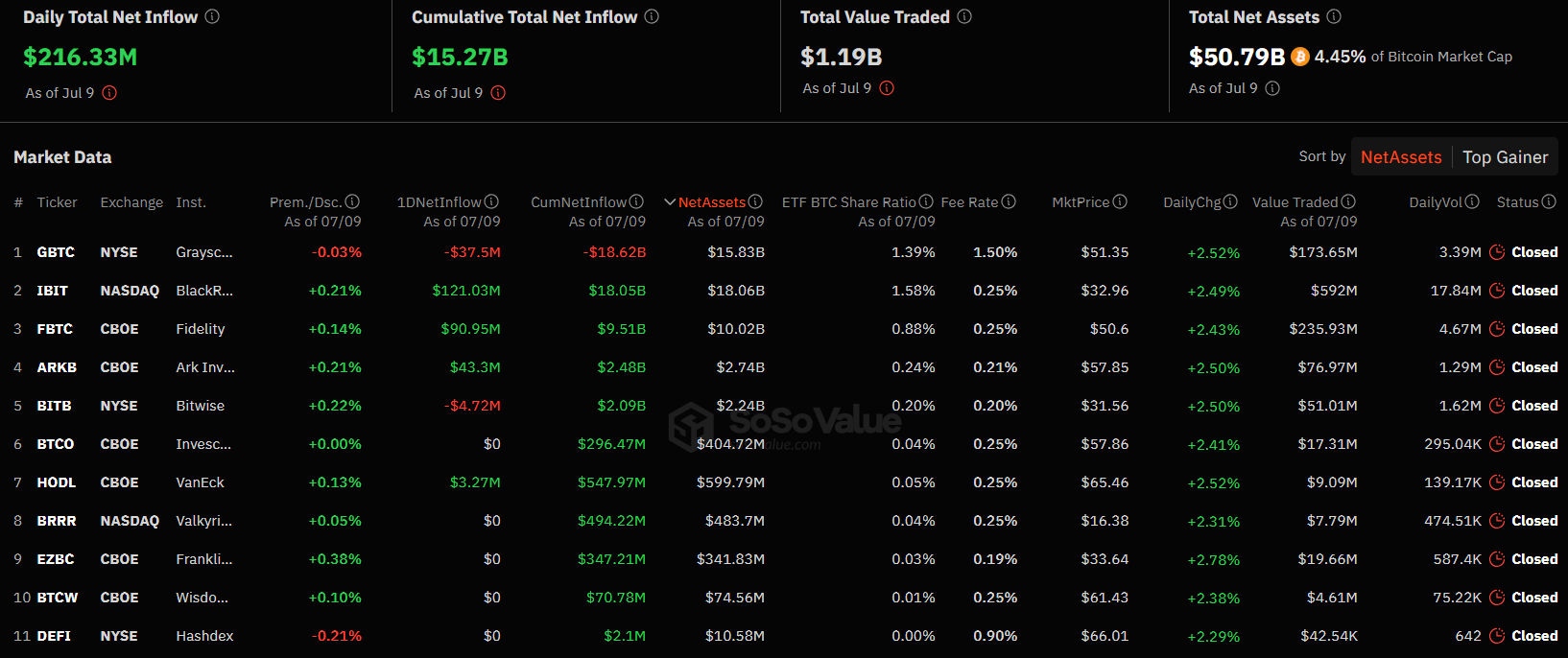

According to the latest reports coming from SoSoValue, Bitcoin ETFs saw inflows totaling $216 million yesterday.

BlackRock’s Bitcoin ETF, IBIT, recorded over $121 million in inflows, while Fidelity’s Bitcoin ETF, FBTC saw almost $90 million.

As of July 9, BlackRock’s total net assets in its Bitcoin ETF are over $18 billion, according to the same data.

The total net assets in all Bitcoin ETFs totaled over $50.7 billion, according to the latest data.