Summary

- Bitcoin ETFs recorded $263 million in inflows on September 13.

- BTC surpassed $60,000 and it’s up by over 3% today.

Bitcoin ETFs recorded a strong inflow day on September 13, when the US-based crypto products recorded over $263 million in inflows.

This was the day with the highest inflows since July 31 when BTC ETFs recorded almost $299 million in influxes.

BTC ETFs Record Highest Inflow Day Since July

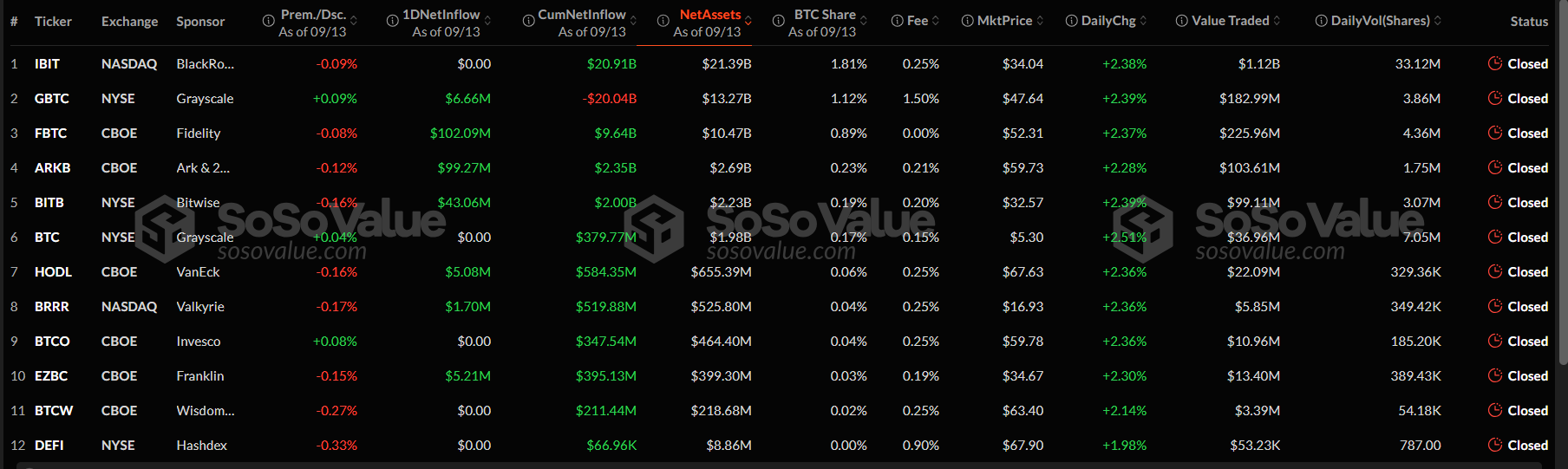

Here are the inflows recorded yesterday in the US-based crypto products:

- Grayscale’s BTC ETF, GBTC, recorded $6.66 million in inflows.

- Fidelity’s BTC ETF, FBTC, recorded over $102 million in inflows.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, recorded over $99 million in inflows.

- Bitwise’s Bitcoin ETF, BITB, recorded $43 million in inflows.

- VanEck’s Bitcoin ETF, HODL, saw over $5 million in inflows.

- Valkyrie’s Bitcoin ETF, BRRR, recorded $1.7 million in inflows.

- Franklin Templeton’s Bitcoin ETF, EZBC, recorded over $5.2 million in inflows.

BlackRock’s Bitcoin ETF, IBIT, did not see any inflows or outflows in their crypto product, and the other BTC ETFs in the US also saw zero influxes/outflows on September 13.

According to the same data, the total net assets locked in US Bitcoin ETFs were $53.4 billion as of September 13.

This was the highest influx day since July 31 when the crypto products saw $299 million in inflows. Another recent remarkable influx day was August 23 when the crypto products recorded $252 million in influxes.

Regarding Bitcoin‘s price, the coin rebounded above $60,000 on September 14.

BTC is Trading Above $60,000

At the moment of writing this article, BTC is trading above $60,000, up by over 3% in the past 24 hours.

Yesterday, BTC reached prices close to $60,600 following a volatile week.

The week was filled with important economic and political events, but they didn’t trigger too intense volatility for the digital asset.

The August US CPI results showed eased inflation, while the week also saw a notable political event – the presidential debate between Donald Trump and Kamala Harris.

Neither of these events did not trigger significant price moves for BTC.

One potential catalyst for Bitcoin’s price could be the next week’s FOMC meeting during which the UD Fed will decide on interest rate cuts in the US.