Summary

- Yesterday, BTC ETFs closed the week with over $273.7 million in inflows.

- BTC ETFs continued a 6-day inflow streak, surpassing $2.1 billion this week alone.

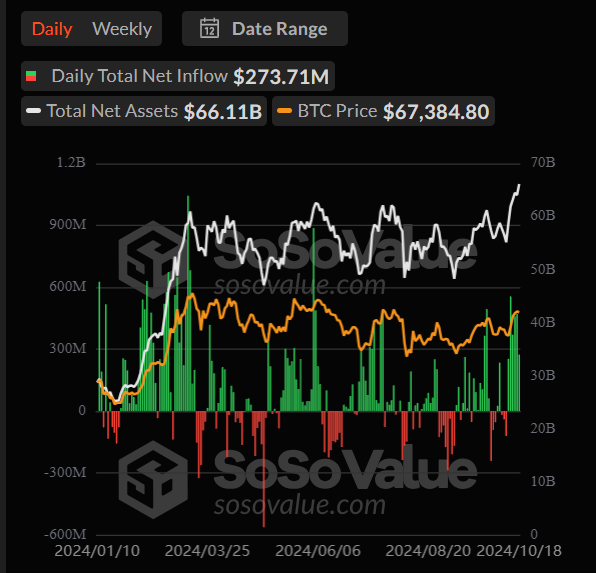

This week was one of the best ones for the US-based Bitcoin ETFs, as the crypto products surpassed $2.1 billion in inflows. The influx streak debuted on October 11 when the BTC ETFs recorded over $253.4 million in inflows.

Bitcoin ETF Inflows on October 18

Yesterday, BTC ETFs in the US recorded over $273.7 million in inflows as follows:

- BlackRock’s Bitcoin ETF, IBIT, recorded $70.4 million in inflows.

- Ark Invest and 21Shares’ Bitcoin ETF, FBTC, saw almost $110 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, saw over $18 million in inflows.

- Bitwise’s Bitcoin ETF, BITB, saw almost $36 million in inflows.

- VanEck’s Bitcoin ETF, HODL, recorded $23.3 million in inflows.

- Invesco’s Bitcoin ETF, BTCO, saw over $16 million in inflows.

The other US BTC ETFs did not see any inflows or outflows the other day.

US BTC ETFs, Faster-Growing Than Gold ETFs

This was the sixth consecutive day when the crypto products recorded significant inflows, with the most notable day being October 14, when the crypto products saw almost $556 million in influxes, according to data from SoSoValue.

The total net assets locked in US BTC ETFs were over $66.1 billion as of yesterday, and the cumulative net inflow in the crypto products was almost $21 billion, signifying increased institutional interest.

It’s important to highlight that the BTC ETFs in the US managed to surpass the important $20 billion level since their launch in January, which is a remarkable thing considering that gold ETFs reached the same number in about 5 years, according to Bloomberg analyst Eric Balchunas.

Along with an impressive performance by BTC ETFs, Bitcoin also had a remarkable week, kicking off a rally on October 14.

BTC Price Holds Above $68,000

At the moment of writing this article, BTC is trading above $68,000, up by 0.5% in the past 24 hours.

Yesterday, BTC reached levels close to $69,000, after debuting a notable rally at the beginning of this week and surged from $62,000 levels to current prices.

The coin’s ascendant trend has been fueled by more factors, including whale buying, remarkable BTC ETF performance, US Fed rate cuts, and rising odds of a Trump win in the 2024 US elections.

BTC’s bullish October performance sparked new ATH incoming predictions, the latest one coming from Bitwise CIO, Matt Hougan.