Summary

- Bitcoin traders expect an upward movement in September.

- BTC is trading above $66,000 today, ahead of important macro data.

Bitcoin traders are still expecting an upward move for the coin’s price this September.

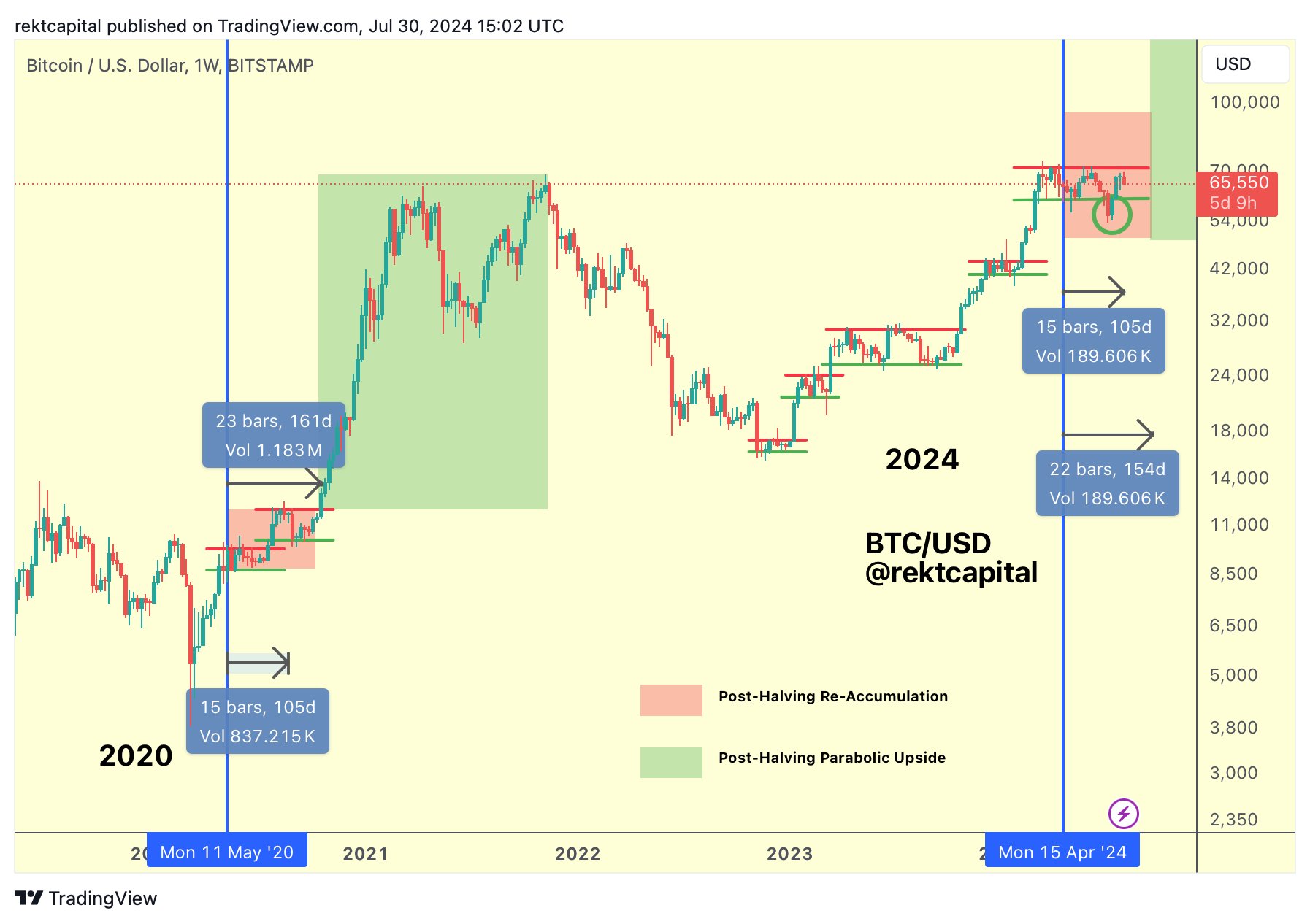

Popular pseudonymous crypto trader, Rekt Capital, shared a post on X on July 30, explaining that Bitcoin is still on track for a price surge in September.

He explained that while the digital asset failed to break out of the reaccumulation range, the period where buyers accumulate in anticipation of more upward price moves, in the 100 days following the Bitcoin halving in April, such a breakout was unlikely.

100 days after the Bitcoin halving which took place on April 20 this year, on July 29, BTC was trading only 2.11% higher around $66,300.

Some other traders believe that BTC will more likely breach the important level of $100,000 sometime in 2025 rather than during this year. Pseudonymous trader Daan Crypto Trades said that the higher timeframe Bitcoin chart looks great to him.

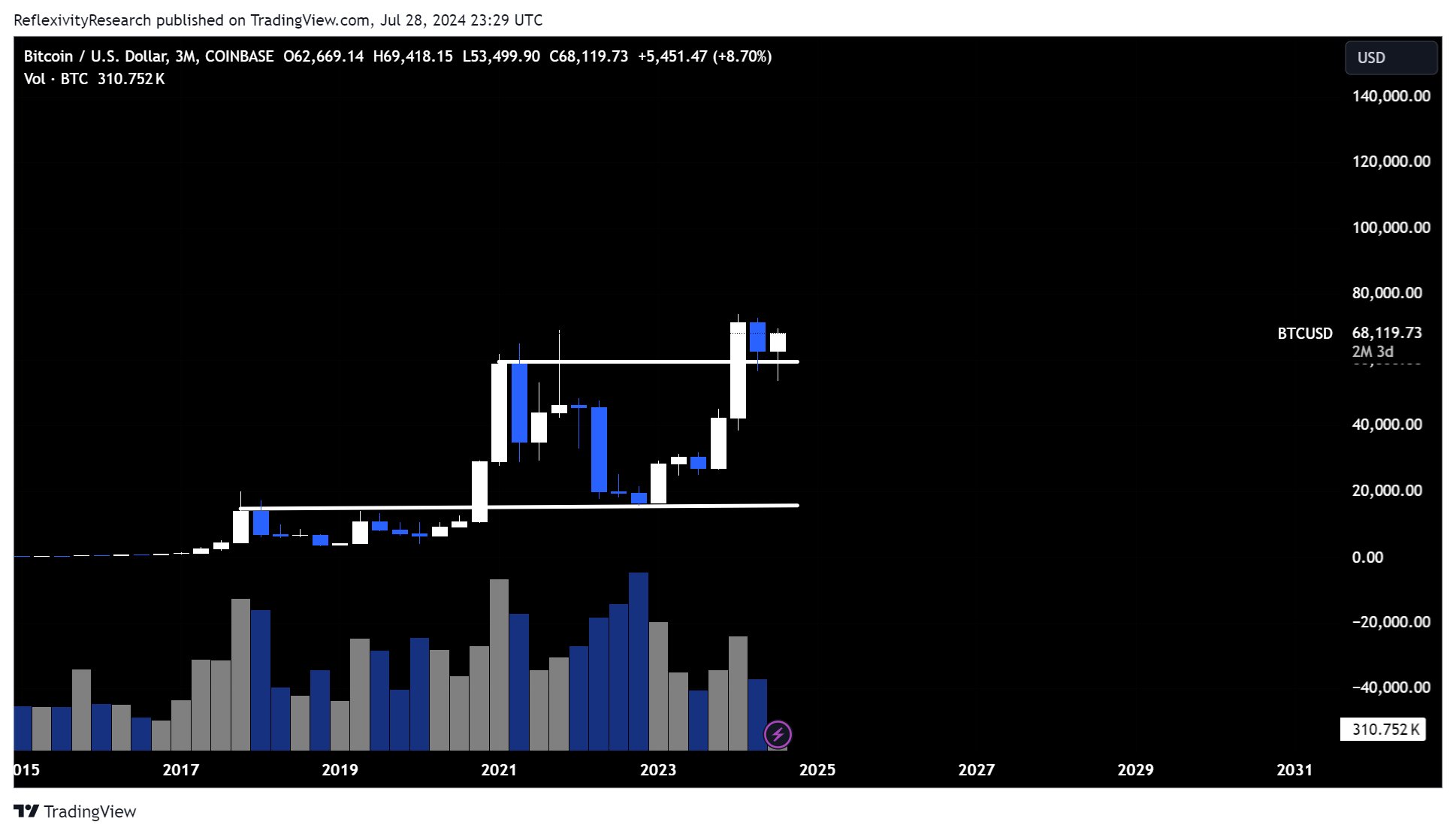

Will Clemente, crypto research firm Reflexivity Research founder, shared a post on X the other day, saying that the Bitcoin quarterly chart is looking insane.

Bitcoin Price Above $66,000 Ahead of Important Macro Events

At the moment of writing this article, Bitcoin is trading above $66,000, after being able to reach prices close to $70,000 on July 29.

This is an important macroeconomic week that can impact Bitcoin and the crypto market.

Here are the top events during the next few days:

- US ADP employment July data (July 31)

- Bank of Japan rate resolution and outlook report (July 31)

- US initial jobless claims (August 1)

- US Fed to reveal interest rate decision communication (August 1)

- Bank of England to communicate interest rate decision (August 1)

- US ISM Manufacturing PMI for July (August 1)

- US July unemployment rate (August 2)

- US non-farm payrolls for July (August 2)

BTC’s price saw a decline following the latest $2 billion transfer from the US government.