Summary

- Bitcoin surged above $66,000 earlier today, for the first time in almost 2 months.

- Amidst more recent bullish events, the crypto market is getting ready for an optimistic Q4.

Bitcoin’s price surged significantly today, surpassing the important level of $66,000. This price level was reached back on July 31, when BTC traded at around $66,200.

At the moment of writing this article, BTC is priced above $65,800, up by 1% today. Earlier, the coin’s price reached a maximum of $66,400.

Bitcoin debuted a notable price rally ahead of the US FOMC’s meeting last week and continued following the Federal Reserve’s decision to cut interest rates by 50 bps.

This week, more significant events triggered a continuous rally for the most important digital asset.

Important Recent Bullish Events This Week

Binance’s CZ Release

Today was an extremely important week for the crypto industry, as the news of a sooner-than-expected release for Binance’s Changpeng Zhao reached the world.

He was supposed to be officially freed on September 29, but, as the date falls on a weekend, official notes revealed that he would be freed today, September 27.

Crypto enthusiasts cannot wait to see an “I’m back,” message from CZ on social media. and, for the crypto community, this was one of the most long-awaited bullish events of the week.

Tron’s Justin Sun just shared a message on his X account, celebrating the event.

Continuous Weekly Inflows in BTC ETFs

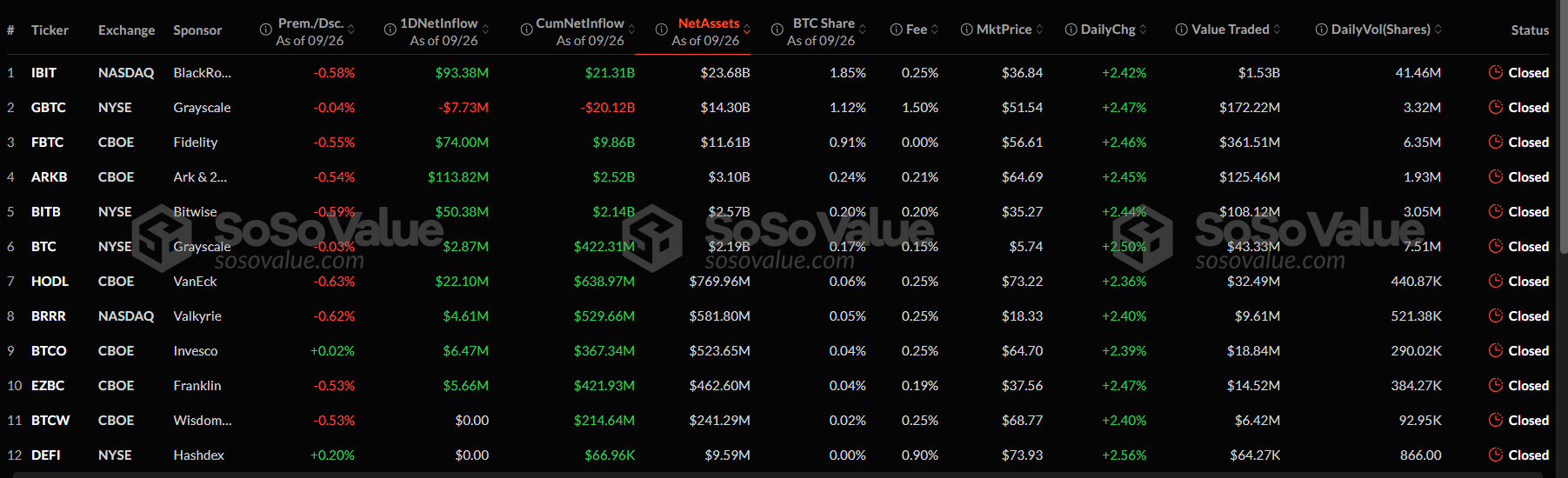

Another notable bullish catalyst for Bitcoin’s price was the continuous flow in US-based Bitcoin ETFs which recorded $365.5 million in inflows on September 26, marking the strongest inflow day since July.

ArkInvest and 21Shares’ Bitcoin ETF led the inflows yesterday with almost $114 million, followed by BlackRock’s Bitcoin ETF, IBIT, with $93.3 million.

It’s also worth noting that the cumulative total net inflow in Bitcoin ETFs surpassed $18.3 million since their launch in January 2024. The continuous flows in the crypto products suggests increased institutional interest in Bitcoin.

Optimistic Economic US data

Also, important economic data in the US was released today showing that the core PCE price index rose by 0.1% in August, which was lower than expectations at 0.2%.

The results suggest that inflationary pressures have eased in the US and the Fed’s monetary policy decisions will probably include more rate cuts this year.

The crypto market has all the reasons to remain optimistic as we’re nearing the closing of BTC’s best September so far, and getting ready to enter a bullish Q4 which may bring a new ATH for the digital asset.