Summary

- The exchange stablecoins ratio dropped to the lowest level in 18 months.

- This means Bitcoin’s declining selling pressure.

It seems that the Bitcoin selling pressure may come to an end, according to an important metric that just hit the lowest level in 18 months.

Bitcoin dipped below $50,000 on August 5 during the crypto and equities markets decline. The coin managed to quickly recover and it may even see a new ATH this year, according to data from Grayscale Research.

An ATH retest could happen only if the US is able to avoid recession, according to their notes, but even under harsher market conditions history might not necessarily repeat itself.

Key Stablecoin Metric Suggests Eased BTC Selling Pressure

According to the latest reports, an important key metric known as the Exchange Stablecoin Ratioo which measures the number of BTC held in wallets tied to centralized exchanges relative to stablecoins is suggesting reduced selling pressure.

New data from CryptoQuant reveals that the ratio has dropped to the lowest level since February 2023, which extended a prolonged downtrend that began back in June 2023.

In a statement made via Telegram, CryptoQuant said that this could suggest that there is reduced selling pressure on Bitcoin, as fewer traders are converting their Bitcoins into stablecoins.

Also, this could suggest that there’s a bullish market sentiment where traders hold Bitcoin in anticipation of future price increases, according to the same reports.

TradingView reveals that the combined supply of USDC and USDT has increased by $2 billion to over $150 billion since the Crypto Black Monday as August 5 has been called by some in the crypto industry. On a year-to-year basis, the combined supply of the two stablecoins has surged by almost 30%.

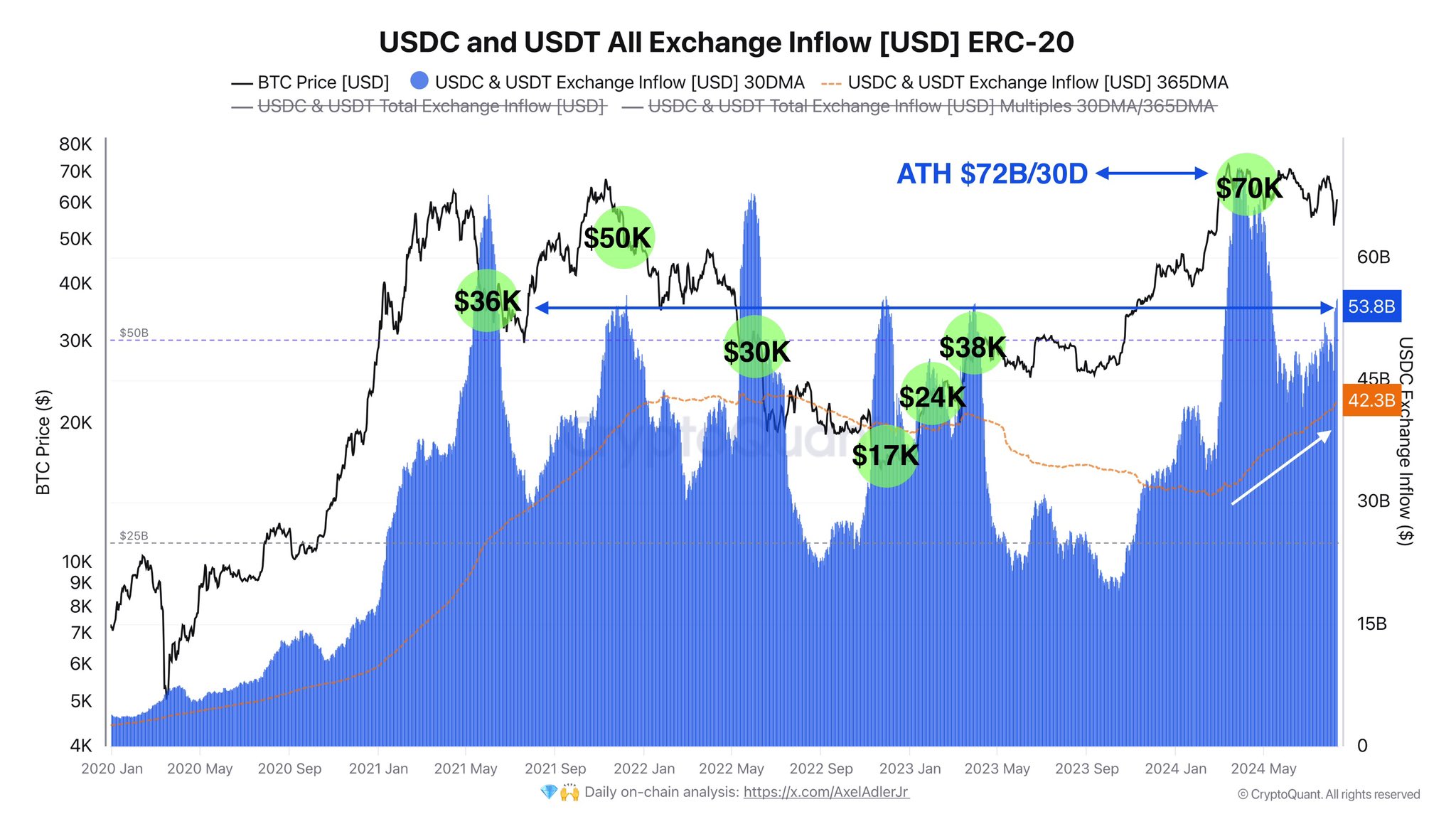

As we already reported earlier today, CryptoQuant author Axel Adler Jr. also noted that the average monthly inflow of USDC and USDT across all exchanges is $53 billion per day, which is above the annual average.

He highlighted that the boost in stablecoin inflows is correlated with BTC purchases.