Summary

- The German Government continues its Bitcoin-selling spree.

- On July 12, they sold 2,700 BTC to exchanges and an address.

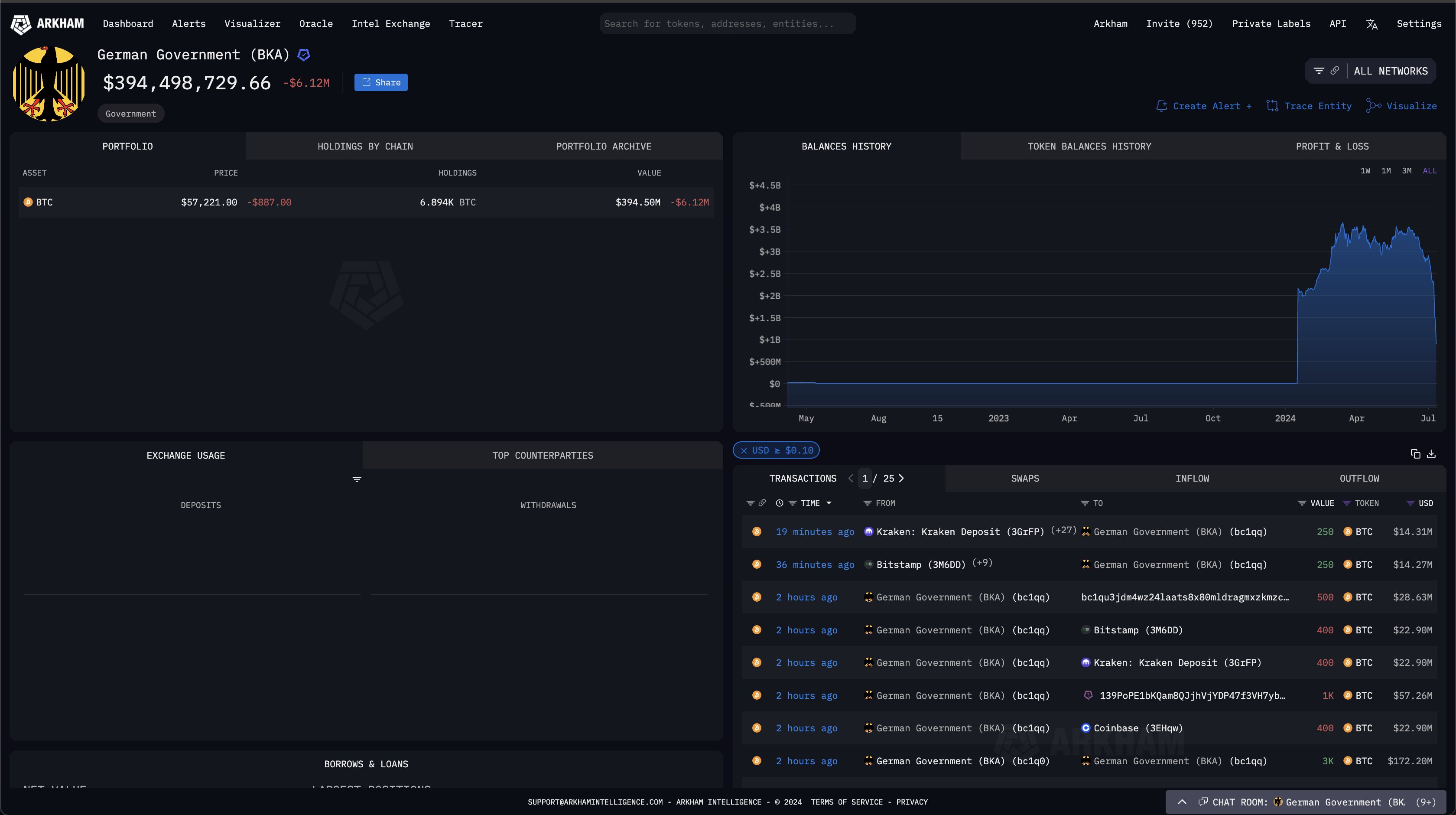

According to the latest reports coming from Arkham Intelligence, the German government continues selling its Bitcoin.

In a new post on X, Arkham noted that in the past hour, the German Government has sent 2,700 BTC worth about $154 million to exchanges including Kraken, Bitstamp, Coinbase, 139Po (probably an institutional deposit or OTC service), and the address bc1qu.

According to the official reports, since the moves that the Government made on July 11, they received 4,169 BTC worth about $239 million back from exchange addresses. These include Kraken, Bitstamp, and Coinbase.

500 BTC were received this morning, Arkham says. This is likely unsold Bitcoin, according to their reports.

Arkham concluded by saying that the German Government is now left with 6,894 BTC worth about $394 million. This translates to 13.8% of the Bitcoin that was originally seized from Movie2k.

German Government Bitcoin Wallet Moves

According to official reports, the German Government’s Bitcoin wallet was holding BTC seized from a film pirating website crackdown that took place back in January 2024.

The governmental wallet has transferred out billions of dollars in Bitcoin since June 19, but it apparently intensified moves at the start of this month.

On July 11, the wallet briefly dropped below 5,000 BTC after it sent 10,620 BTC to crypto exchanges including Coinbase, Bitstamp, Kraken, Flow Traders, and two anonymous addresses, according to the reports coming from Arkham.

On the other hand, it’s worth noting that shortly after that, some of those funds were transferred back to the German Government wallet, which brought its BTC holdings back above 9,000 BTC ahead of the moves that have been made today.

This sell-off coming from the governmental wallet, combined with worries surrounding the Mt. Gox repayment of funds to creditors have been the most important triggers for BTC price drops in the market recently.

At the moment of writing this article, Bitcoin is trading above $57,000, following a surge in price over $59,000 from July 11 after the CPI report came out showing an eased inflation for June.