Summary

- Currently, the BTC whale has 3,000 BTC, held since late 2016.

- Bitcoin remains surrounded by optimism fueled by important global factors.

Arkham Intelligence revealed that a Bitcoin whale has just woken up after over eight years of holding. The whale moved its BTC, which had been held since late 2016.

Today, Bitcoin is trading above $84,000, following an earlier dip to $83,000 levels.

Bitcoin Whale Wakes Up After 8 Years

According to on-chain data, the whale called 250M BTC Whale woke up on March 22, early in the morning, and moved its holdings. The whale had been holding 3,000 BTC which is currently worth almost $253 million at current prices.

The whale moved its holdings to one of its wallets, Arkham data shows.

At the beginning of 2017, BTC was worth between $900 and $1,000, which means that back then, the 3,000 BTC held by the whale was worth around $3 million. The BTC whale made a profit of over 84x by holding its coins.

$250M BITCOIN WHALE WAKES UP AFTER 8 YEARS

A Bitcoin Whale that has held BTC since late 2016 has just moved over $250M in BTC last night.

His Bitcoin stack went from $3M in early 2017 to over $250M today – and he’s held Bitcoin on one address for over 8 years. pic.twitter.com/RF1aewYVgy

— Arkham (@arkham) March 22, 2025

Today, Bitcoin price recorded a rebound above $84,000, from an earlier dip below the level.

Bitcoin Trades Above $84,000

At the moment of writing this article, BTC is trading above $84,000, after an earlier drop to $83,000 levels.

Despite recent volatility, Bitcoin remains surrounded by optimism due to multiple factors including continued renewed interest in BTC ETFs, the latest FOMC meeting, Trump’s support, and the recent move made by IMF.

Institutional Interest in BTC Continues

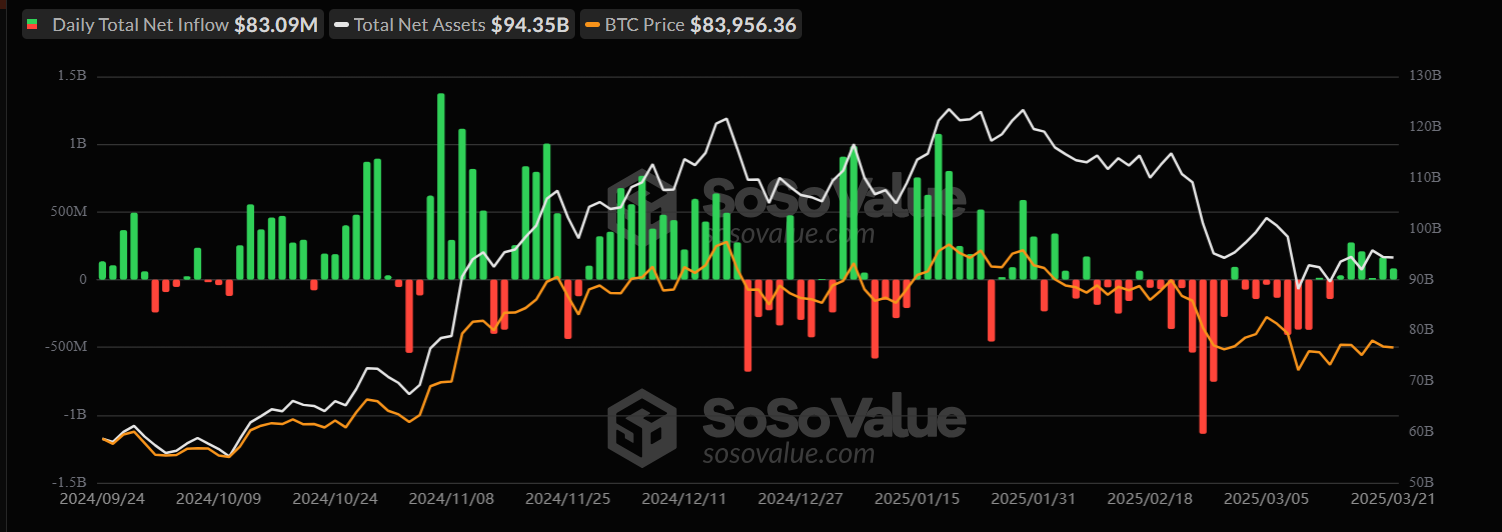

After a longer period in which the US BTC ETFs recorded constant outflows, in the past six days, the crypto products saw over $776 million in inflows, according to data from SoSoValue.

From March 14 to March 21, the US BTC ETFs saw consecutive inflows with the biggest one recorded on March 17 above $274 million.

As of March 21, the total net assets locked in BTC ETFs were over $94,3 billion, and the cumulative net inflow in the crypto products since their January 2024 launch was over $36 billion.

The latest consecutive days of inflows in BTC signals renewed institutional interest.

Bitcoin – Surrounded by Optimism

Together with continued institutional interest in BTC, more factors are continuing to optimism fueling the markets.

Trump’s latest moves in the US are signaling an upcoming codification into law of his previous Executive Order of a Strategic BTC Reserve.

Also, the IMF has recently added Bitcoin and crypto to its financial framework, highlighting that BTC is more like a store of value and an investment tool – practically, the IMF has just recognized Bitcoin’s status as digital gold, which translates into bullish times ahead.

Max Keiser, BTC pioneer and Advisor to El Salvador’s President Nayib Bukele, shared a post today on X, saying that sources confirmed the fact that the IMF will add BTC to their own reserves, and will add the digital asset to the SDR basket/index.

BREAKING: SOURCES confirm: The IMF is adding Bitcoin to their own reserves and will soon add Bitcoin to the SDR basket/ index. https://t.co/fN1takq7SA

— Max Keiser (@maxkeiser) March 23, 2025

With the IMF’s recognition of BTC, trust in the industry will continue to grow worldwide attracting more capital to the markets.

With a growing M2 global supply, significant capital is about to enter BTC and crypto, according to the latest predictions.