Summary

- BlackRock just released a Bitcoin report, calling the asset a unique diversifier.

- With over $10 trillion in AUM, the company is expected to top $15 trillion in the next years.

BlackRock has just released an important Bitcoin report that’s making waves in the crypto industry.

The company is the largest asset manager in the world with over $10 trillion in assets under management (AUM), and its support for Bitcoin speaks for itself.

Bitcoin a Unique Diversifier

The report is called “Bitcoin: A Unique Diversifier” and explains why Bitcoin’s appeal to investors lies in its detachment from traditional risk and return drivers.

BlackRock begins its report by explaining Bitcoin and why it matters.

The report highlights the persistent historical challenges around money, including the following:

- Prone to inflation and debasement given a non-fixed supply

- Difficulty transacting across borders

- Limited access to one’s particular country, controlled by a central authority

By comparison, the report highlights what Bitcoin makes possible:

- Fixed maximum supply at 21 million, with supply growth declining every 4 years

- Digitally native and borderless, allowing almost instant transactions, and global transfers of value

- First truly open-access global monetary system

Bitcoin Outperformed All Major Asset Classes in 7/10 Years

BlackRock also mentioned that Bitcoin outperformed all major asset classes in 7 out of the last 10 years, highlighting that this performance was achieved despite BTC being the worst-performing asset in 3 out of the 10 years.

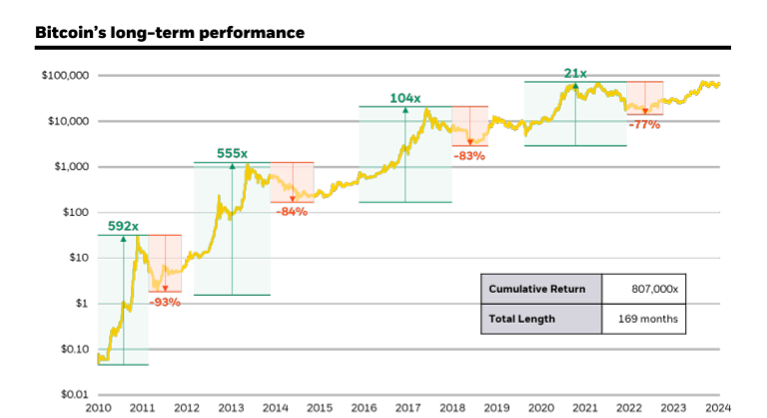

They also shared BTC’s long-term performance from 2010 to 2024.

According to data gathered by them, the cumulative BTC return is over 807,000x in 169 months. The graph shows Bitcoin’s performance from July 19, 2010 to July 31, 2024.

Bitcoin, an Uncorrelated Asset

Another issue that BlackRock addresses in the report is the fact that Bitcoin reflects little fundamental exposure to other macro variables, explaining its long-term average correlation with equities and other risk assets.

They mentioned that there have been periods in which BTC has seen its correlation spike (especially around episodes of sudden shifts in the US dollar real interest rates or liquidity) these episodes have been short-lived in nature.

They revealed a graph showing BTC has exhibited a low historical correlation with US equities with periods of dislocation.

BlackRock also made a comparison between the S&P 500, gold, and Bitcoin through major geopolitical events, showing BTC’s appreciation compared to the other assets during these periods.

According to BlackRock’s notes, Bitcoin was a better performer during the 2020 US election challenges and during the US regional banking crisis in March 2023 as well.

US Debt Dynamics Re-Enters Focus

BlackRock also mentioned the US debt and federal deficits that trigger the potential of alternative reserve assets as a potential hedge against possible future events affecting the US dollar.

They also mentioned the recent expanding institutional interest in Bitcoin.

At the end of their report, BlackRock noted that it’s still important to highlight that Bitcoin is a risky asset and should be treated appropriately.

BlackRock has invested in Bitcoin via its Bitcoin ETF, IBIT which held $21.57 billion in total net assets locked in this crypto product as of September 17.

2024, an Important Year For Bitcoin

2024 has indeed seen increasing institutional adoption for Bitcoin, not to mention the surging political interest around the digital asset and the crypto industry as a whole. This is an election year and the results will definitely be important for the future of Bitcoin.

So far, the US Republican candidate Donald Trump has been showing the highest support for Bitcoin throughout the year.

It’s also worth noting that the Trump family has already debuted their World Liberty Financial crypto initiative showing support for the industry and the willingness to “take on the banks” and give the power and financial opportunities back to the people.