Summary

- Fink warned that if the US doesn’t get its debt under control, the US risks losing its world reserve currency status to Bitcoin.

- BlackRock also invested in BTC and its BTC ETF, IBIT, amassed over $48 billion of net assets locked in the product.

In his latest letter to investors, BlackRock’s CEO, Larry Fink, promised to open up private markets to the millions of ordinary investors, not just the wealthy few, according to reports quoted by Bloomberg.

He also said that the US dollar’s world’s reserve currency is not guaranteed to last forever and could lose its position to digital assets like Bitcoin.

Fink also said that tokenization can revolutionize inventing, enabling stocks, bonds, and funds to benefit from the blockchain tech.

BlackRock is the world’s largest asset manager with more than $11.5 trillion in AUM as of 2024.

A Shift From the US Dollar to Bitcoin

In Fink’s letter to investors, called The Democratization of Investing – Expanding prosperity in more places for more people, he addressed a potential change in interest from the US dollar to digital assets like Bitcoin.

He said that if the US doesn’t get its debt under control and deficits continue to grow, the country risks losing its world reserve currency to Bitcoin.

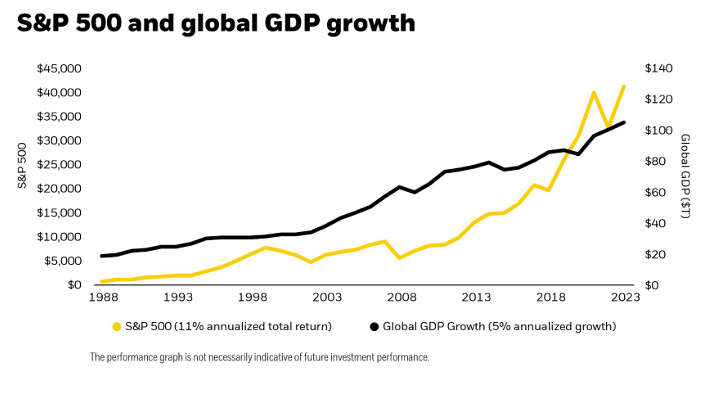

He noted that the US has benefited from the dollar serving as the world’s reserve currency for decades, but there are no guarantees that this will last forever. The national debt has grown at three times the pace of GDP since 1989.

In 2025, the US government interest payments will surpass $952 billion to exceed defense spending, and if the situation doesn’t change by 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit.

This year, the US federal debt is 100% of the GDP.

Fink highlighted his stance on digital assets, saying that he’s obviously not against them and DeFi is an extraordinary innovation, making markets:

- Faster

- Cheaper

- More transparent

However, the innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the US dollar.

BlackRock also invested in the crypto industry, with its BTC ETF, IBIT, amassing over $50 billion of AUM in less than a year. Last year in March, Fink said that IBIT was the fastest-growing ETF in history.

Recently, BlackRock launched a Bitcoin-related ETP in Europe as well, supporting adoption in the region.

Tokenization and AI

Apart from Bitcoin, Fink also said that tokenization is democratization, and it could help turn real-world assets like stocks, bonds, and real estate into digital tokens tradable online via blockchain tech.

He addressed the AI issue, highlighting the boom in the industry and the worry that AI could eliminate jobs – he believes that this is a valid concern, however, as wealthy societies face inevitable labor shortages, AI “may be less a threat than a lifeline.”

Meanwhile, Bitcoin is already seeing increased global adoption, and the US is getting ready to switch its gold reserves to the digital form of the precious metal.