Summary

- BlackRock now has 344,008 Bitcoins and the total net assets were $21.05 billion as of August 9.

- While some investors panic sell, the company continues to buy BTC.

According to the latest reports, BlackRock now owns 344,008 Bitcoins worth around $20 billion at current prices.

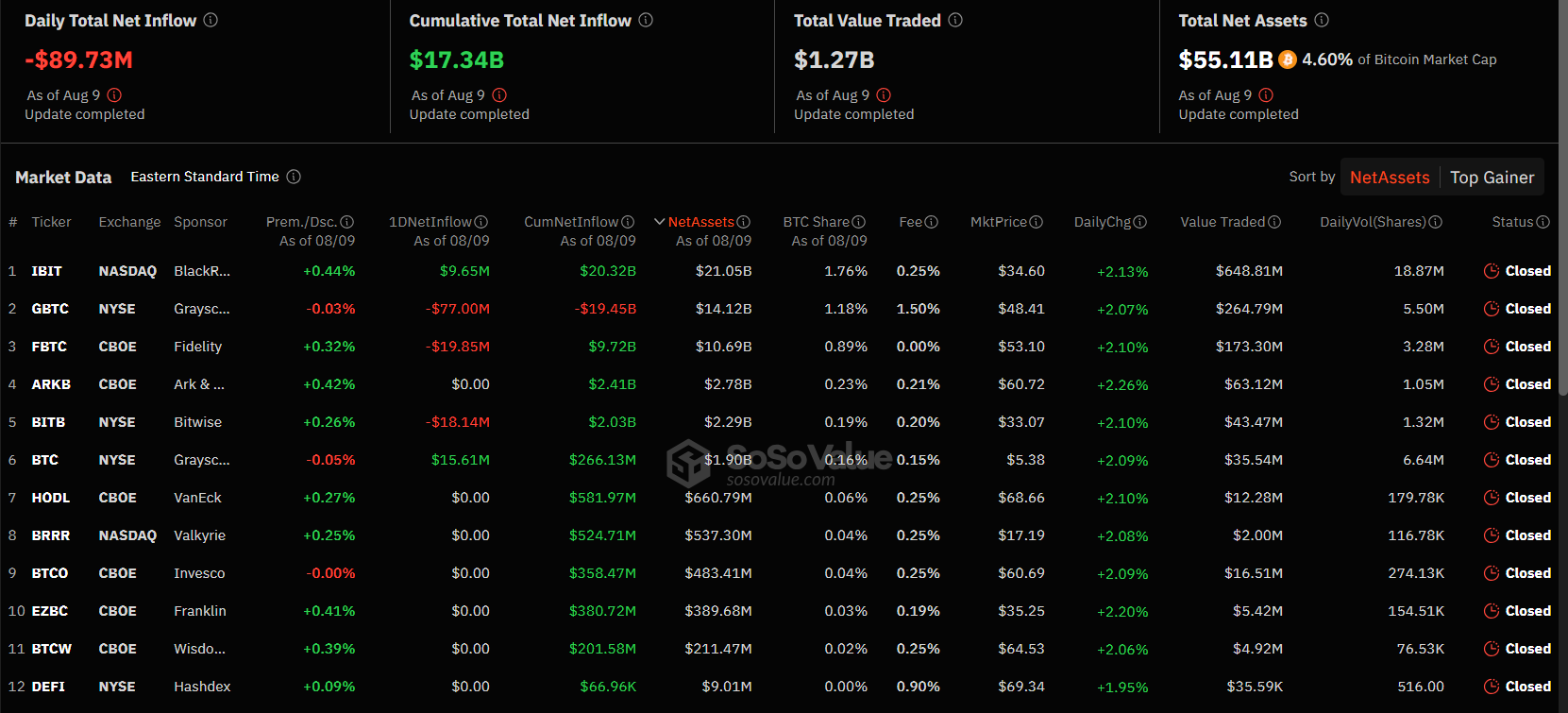

Whale Insider shared a post on X highlighting the company’s BTC holdings, and data from SoSoValue reveals that the total net assets locked in their BTC ETF, IBIT, were $21.05 billion as of August 9.

SoSoValue official data shows that since the launch of BlackRock’s Bitcoin ETF, IBIT, back in January 2024, the crypto product saw a single day of outflows on May 1, 2024.

On August 9, while the US-based Bitcoin ETFs saw outflows of almost $90 million, IBIT recorded inflows totaling $9.65 million. Last week, IBIT recorded inflows of $220 million.

Grayscale’s Bitcoin ETF, BTC, was the only other US crypto product that saw inflows totaling $15.62 million on August 9.

Bitcoin Above $59,000

Regarding Bitcoin’s price today, at the moment of writing this article, BTC is trading above $59,500 following a recent spike in price.

Earlier, BTC traded around the $58,000 level following a drop in price over the weekend triggered by recession fears, and the geo-political factors triggering instability.

However, Bitcoin’s price remains surrounded by optimistic predictions, especially following its capacity to bounce back after the August 5 dip below $50,000 which saw both equities and crypto markets tumbling.

A few days ago, Grayscale shared a report noting that even if usually major token prices have a low correlation with other asset classes, traditional market volatility can also affect crypto valuations.

Bitcoin managed to bounce back from the dip relatively fast, reaching prices of over $62,000 on August 8.

According to Grayscale Research, we might even expect Bitcoin to retest its ATH in 2024, but under the condition that the US economy is able to avoid recession and remains on a path to a soft landing.