Summary

- BlackRock’s BTC ETF, IBIT, recorded its largest influx day since March on July 22.

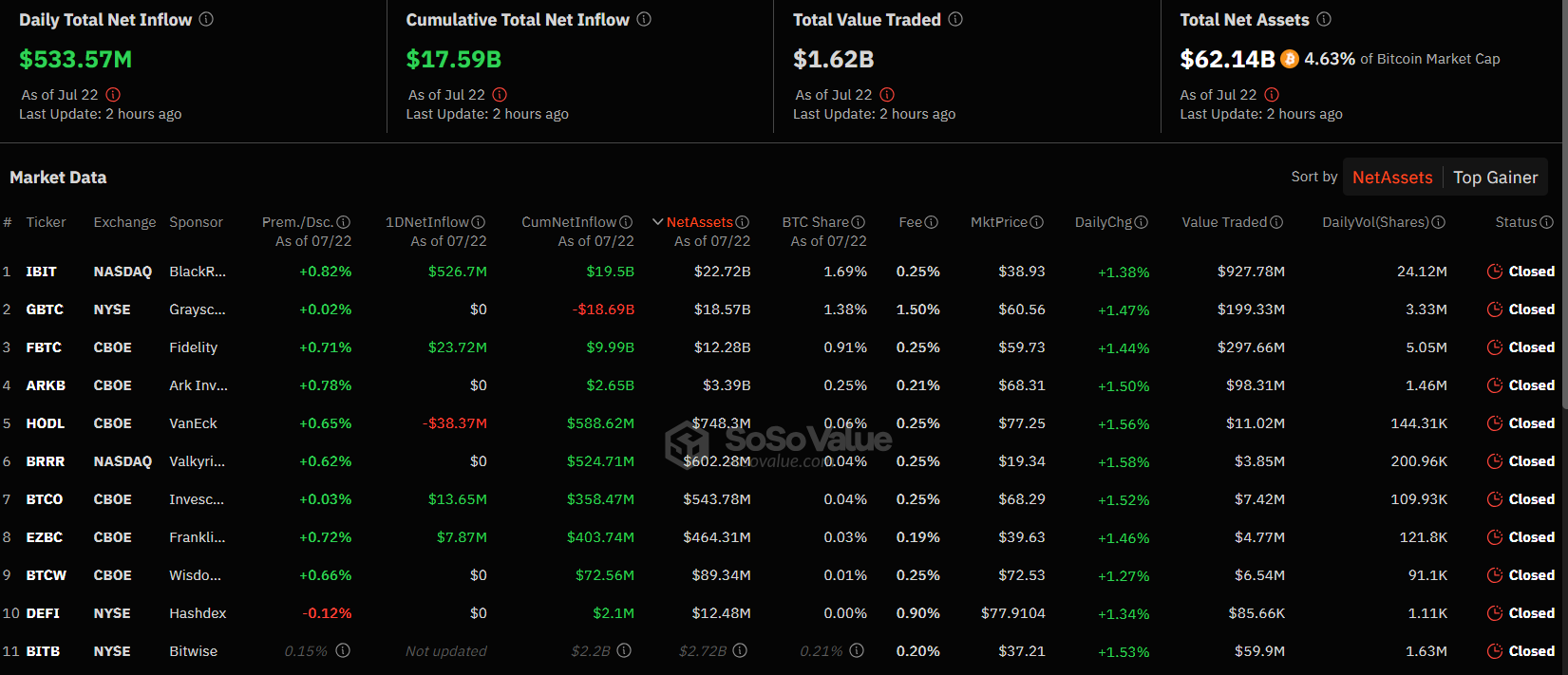

- US BTC ETFs saw $533.57 million in inflows.

According to the latest reports from SoSoValue, the US-based Bitcoin ETFs recorded their 12th consecutive day of inflows on July 22.

BTC ETFs saw $533.57 million in inflows yesterday, with BlackRock’s Bitcoin ETFs, IBIT, recording its largest influx day since March at $526.7 million.

Fidelity’s Bitcoin ETF, FBTC, saw $23.7 million in inflows and Invesco and Galaxy Digital’s Bitcoin ETF, BTCO, saw $13.65 million in inflows.

Franklin Templeton’s Bitcoin ETF, EZBC, saw $7.87 million in inflows the other day.

Only VanEck’s Bitcoin ETF, HODL, saw $38.3 million in outflows yesterday, and the other Bitcoin ETFs in the US did not record any inflows or outflows.

The total net assets in BTC ETFs are $62.1 billion as of July 22.

BlackRock’s Fund at 333,000 BTC

The latest day of inflows in BlackRock’s IBIT brings the total inflows into the fund at 333,000 BTC worth approximately $22 billion at current prices.

July 22 was the seventh-largest day on record for inflows into their Bitcoin ETF.

IBIT recorded its largest single day of inflows on March 18, when $849 million worth of BTC was added to their fund.

The second largest day on record for BlackRock’s fund was March 5, when IBIT saw $788 million in inflows, according to official data.

Regarding the price of Bitcoin today, at the moment of writing this article, BTC is trading above $66,000.

Bitcoin Price Triggers

Analysts are bullish on Bitcoin’s price based on several factors including Joe Biden’s last-minute drop-out from the presidential race in November.

Also, analysts are citing the spot Ethereum ETFs as bullish catalysts for the entire crypto market, and the crypto products are expected to generate 10% to 20% of the flows that Bitcoin ETFs have been generating since their approval for going live back in January.

Donald Trump’s heightened odds of winning the US elections are also seen as a price catalyst for Bitcoin, as he has been showing his support for crypto in the past months.