Summary

- The net amount in Bitcoin miners’ reserves is at 713,000 BTC.

- Despite the average income drop post the 2024 halving, Bitcoin miners are not at risk.

According to the latest data gathered by CryptoQuant qualified author Axel Adler Jr., Bitcoin miners are not currently at risk, despite seeing their average income drop post the 2024 Bitcoin halving event.

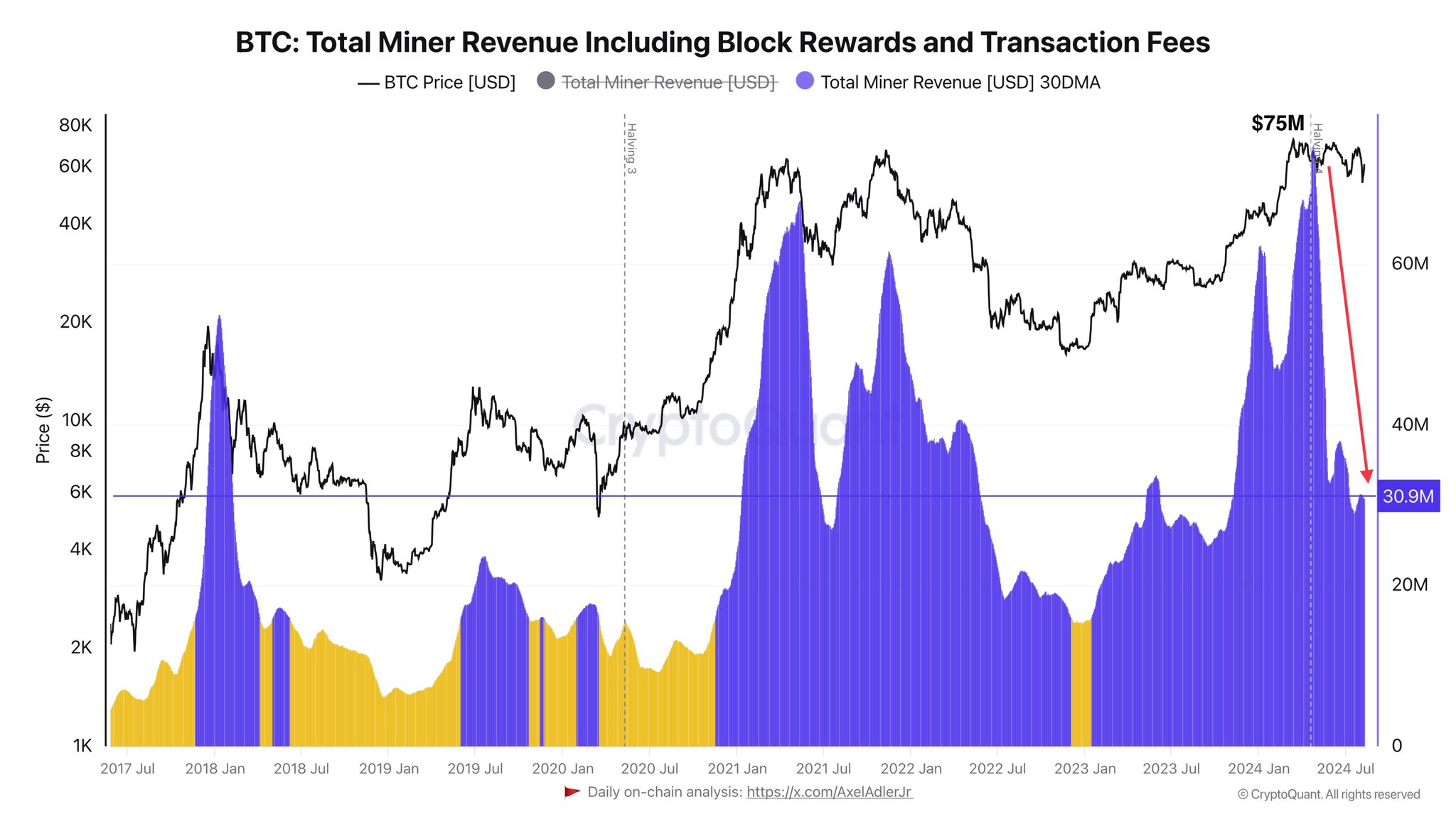

In a new post via X, he notes that after the halving event, miners’ average income dropped from $75 million to $30 million, which means a decrease of 60%.

Over 720 days, their reserves decreased by 50,000 BTC because miners were purchasing new equipment.

According to Adler, BTC miners are not at risk for the moment, as their net amount in reserve remains at 713,000 BTC totaling over $42 billion.

Adler continued and noted that although he is not a big fan of MACD, there is a bullish pattern forming on the daily timeframe. He said that the good news is that many traders are noting this.

Bitcoin Purchases Continue

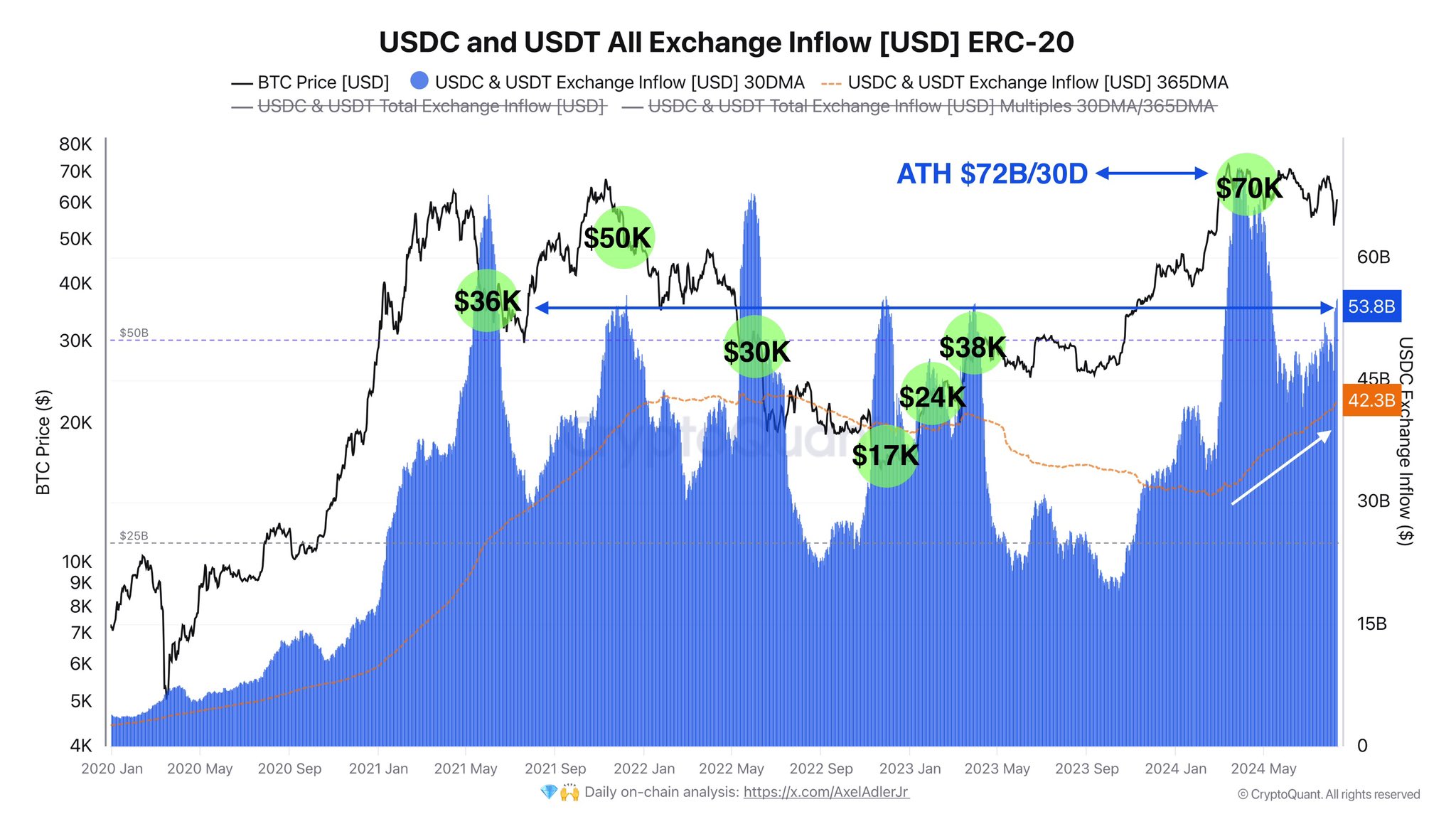

Adler noted in a post on X from August 12 that the average monthly inflow of USDC and USDT across all exchanges is $53 billion per day, which is above the annual average.

The record inflow of $72 billion per day took place when the Bitcoin price was at $70,000.

He highlighted that the increase in stablecoin inflows directly correlates with Bitcoin purchases.

On August 12, Lookonchain also revealed that there has been significant on-chain movement again following a short break.

On X, they noted that Cumberland received $75 million in USDT from Tether Treasury and transferred the funds to exchanges.

Yesterday, before the transfers, Lookonchain reported that institutions seemed to have taken a break and temporarily stopped buying BTC.

Regarding Bitcoin‘s price today, at the moment of writing this article, BTC is trading at $59,000, up by 1% today.