Key Points

- GameStop announced a proposed private offering of $1.3 billion of convertible senior notes.

- Today, BTC is trading above $87,000 ahead of a massive options expiry on March 28.

GameStop, the video game retailer, announced that its board agreed to create a Bitcoin treasury, and the first amount that will be invested in BTC has been disclosed.

Today, Bitcoin rebounded from $86,000 levels, ahead of Q1 options expiry on Deribit scheduled for March 28.

GameStop to Raise $1.8 Billion for Bitcoin Investments

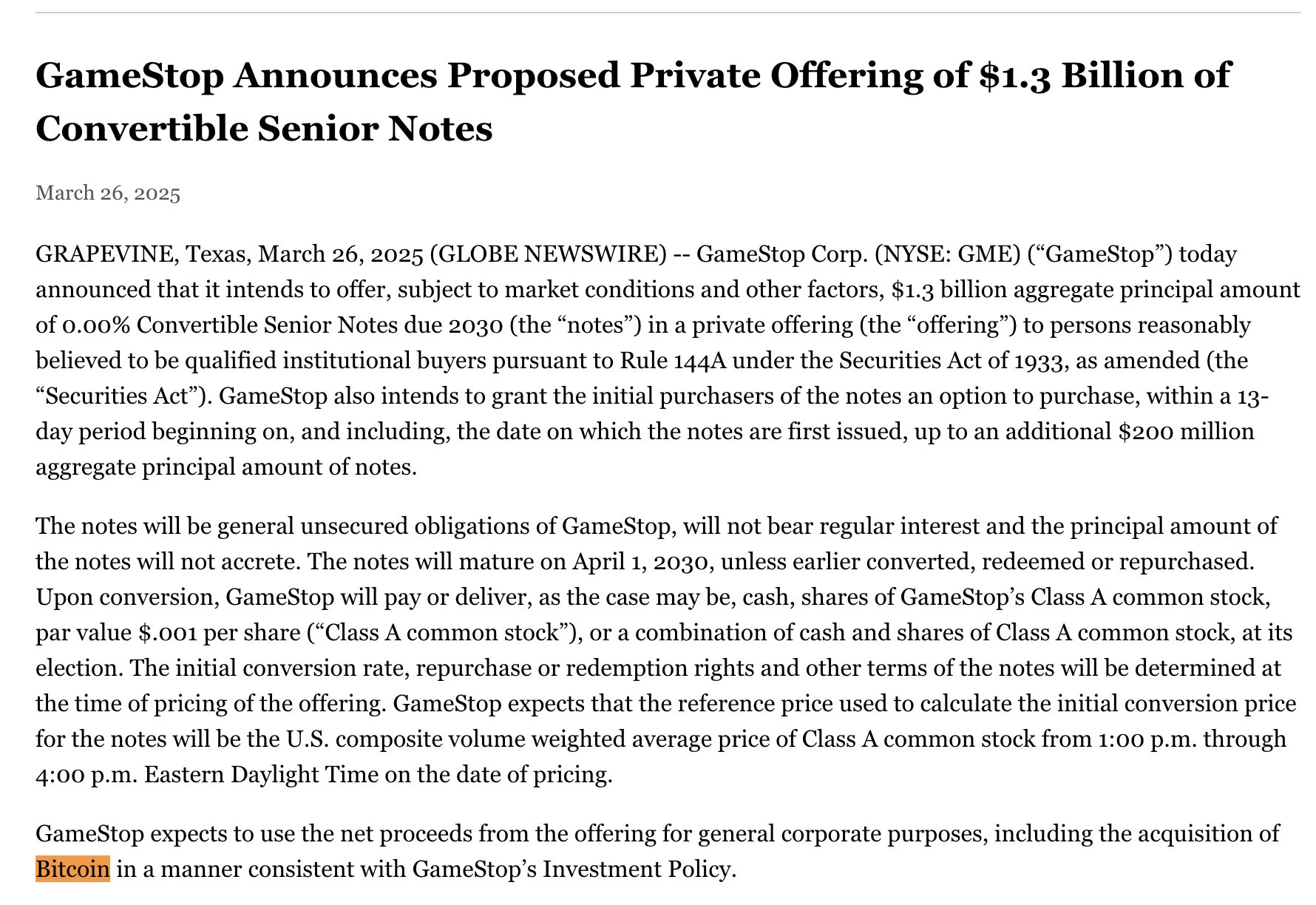

In an official release dated March 26, the company announced that it intends to offer $1.3 billion aggregate principal amount of 0% Convertible Senior Notes in a private offering to qualified institutional buyers.

The notes will mature on April 1, 2030, and GameStop expects the net proceeds of the offering to be used for corporate purposes, including the acquisition of Bitcoin.

The announcement came right after the company revealed that its board agreed to add Bitcoin to its Treasury reserves yesterday.

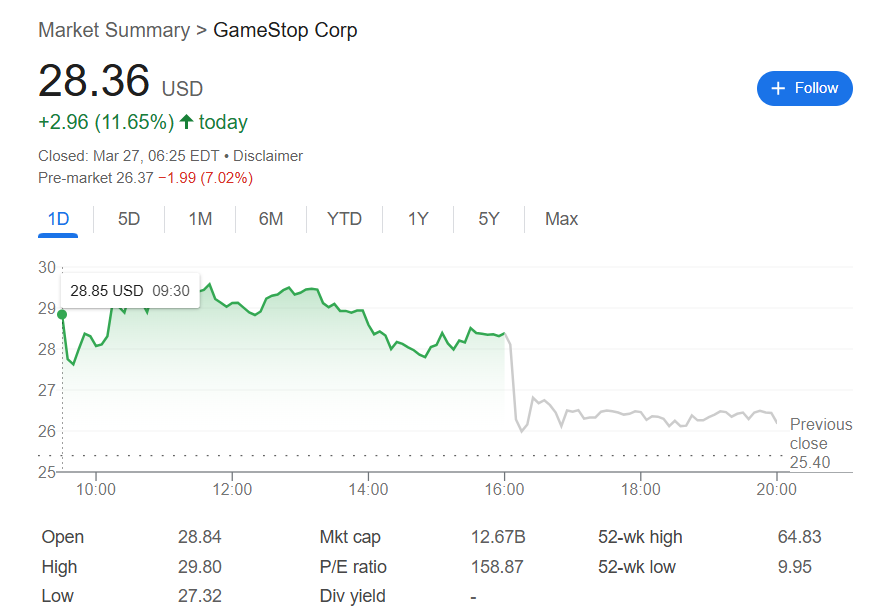

The event was followed by a surge in the price of some GameStop-related digital assets, and the company’s stock also experienced an overall surge in the past week.

Today, the firm’s share is up by over 11%, and it’s priced at $28.36.

This will be the company’s first Bitcoin investment, following in the footsteps of Strategy, which began buying BTC back in August 2020, and continued purchases regardless of market volatilty.

Today, Bitcoin recorded a slight rebound ahead of an important day for the crypto market.

Bitcoin Price Rebounds Ahead of March 28 Options Expiry

At the moment of writing this article, BTC is trading above $87,000, following an earlier dip below the level on March 26.

Institutional interest in Bitcoin continues to grow, and this is also mirrored by the latest nine consecutive days of continued inflows in the US BTC ETFs.

Volatilty Expectations are Low

Tomorrow, March 28, is an important day as it marks the Q1 options expiry on Deribit.

Over $12.17 billion in BTC options will expire with a Max Pain Point of $85,000 and a Put/Call ratio of 0.48.

🚨 Q1 Options Expiry Alert 🚨

Tomorrow is not just any Friday, it’s one of the biggest expiries of the year.

Over $14.3B in BTC and ETH options are set to expire at 08:00 UTC.$BTC: Notional: $12.17B | Put/Call: 0.48 | Max Pain: $85K$ETH: Notional: $2.15B | Put/Call: 0.39 |… pic.twitter.com/7hE2CO15E9— Deribit (@DeribitOfficial) March 27, 2025

It’s worth noting that today, BTC’s price is higher compared to the Max Pain Point, unlike in the past weeks.

The market doesn’t expect to see much volatility on Friday, according to the latest reports, unless an external factor intervenes.

So far, optimism remains present amidst increased institutional adoption and friendly crypto policies in the US.