Summary

- Japan’s Metaplanet bought 21.88 BTC today, raising its holdings to 225.6 BTC.

- BTC’s price is below $63,000 following the recent Mt. Gox moves.

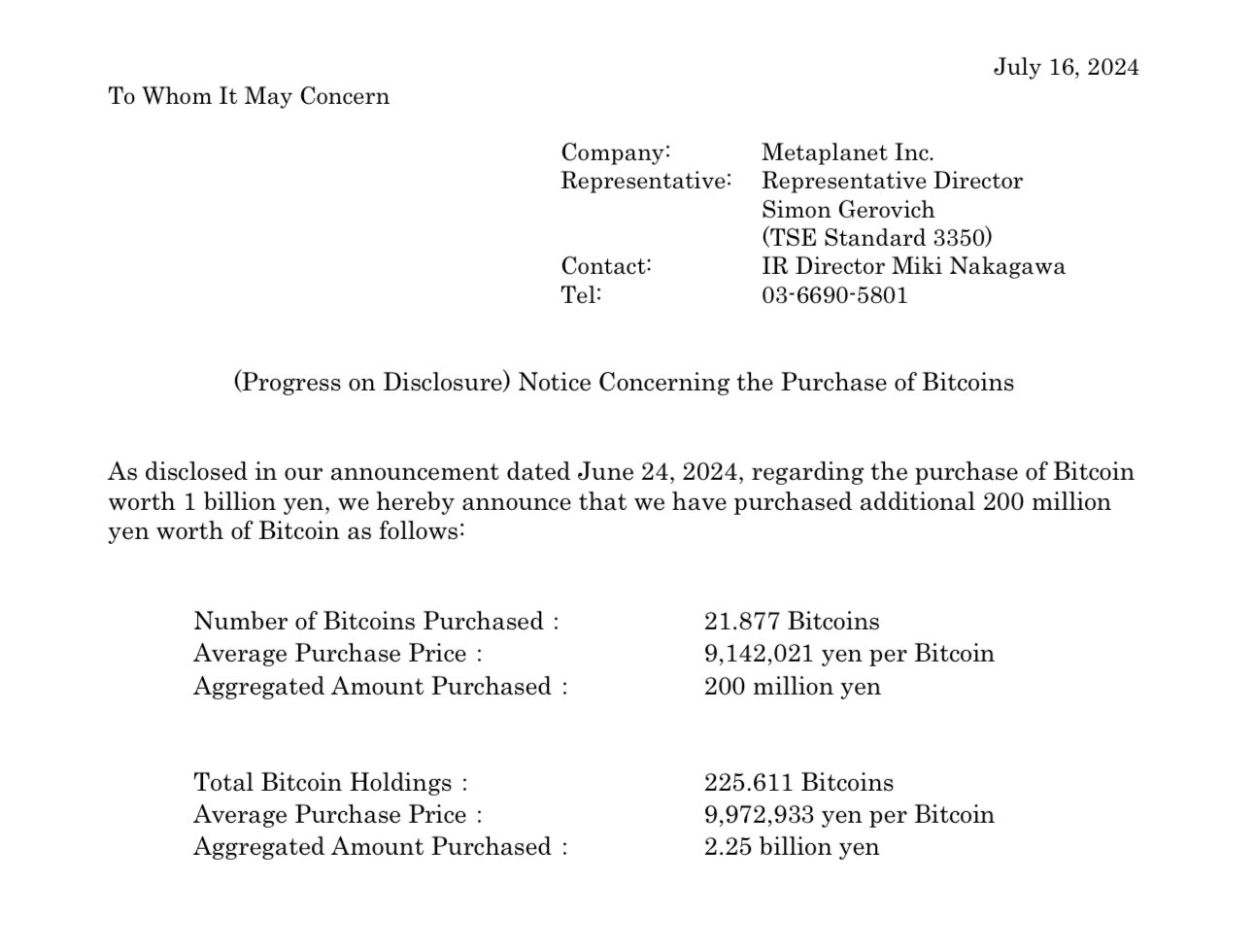

Japan’s Metaplanet has just bought 21.88 Bitcoins worth over $1.3 million today, according to the latest reports.

New official data revealed that the firm’s Bitcoin holdings are now 225.6 BTC worth over $14 million at current prices.

In a new post on X, Metaplanet revealed the official statement which says that according to their June 24 announcement, regarding the purchase of Bitcoin worth 1 billion Japanese yen, they are announcing the purchase of additional coins.

They reportedly paid over 9 billion Japanese yen per Bitcoin, according to the official reports.

It’s also worth noting that the firm took advantage of Bitcoin’s price drop earlier this month, and bought 42.46 BTC on July 7 for $2.5 million or 400 million Japanese yen.

Metaplanet is known as “Asia’s MicroStrategy” due to its similar Bitcoin path that Michael Saylor’s Microstrategy took back in 2020.

In a similar way to the American company, Metaplanet said back in May that it would adopt an entire range of capital market instruments to boost its Bitcoin reserves.

The firm adopted this strategy of hedging against Japan’s worsening debt burden and the depreciating Japanese yen.

Regarding Bitcoin’s price today, the coin saw a drop in its price due to the latest Mt. Gox moves.

BTC Below $63,000

At the moment of writing this article, BTC is trading below $63,000, after being able to reach levels near $65,000.

The price drop is due to the latest moves made by the defunct Mt. Gox crypto exchange.

According to Arkham Intelligence reports, a BTC wallet associated with Mt. Gox transferred about $2.7 billion in BTC to an unknown address.

This large move came after another smaller move of 0.021 BTC from the exchange to an unknown address. This is presumed to be a test transfer, according to reports.

However, institutional money continues pouring into Bitcoin. We earlier reported that the US BTC ETFs recorded their 7th consecutive day of inflows on July 15.