Summary

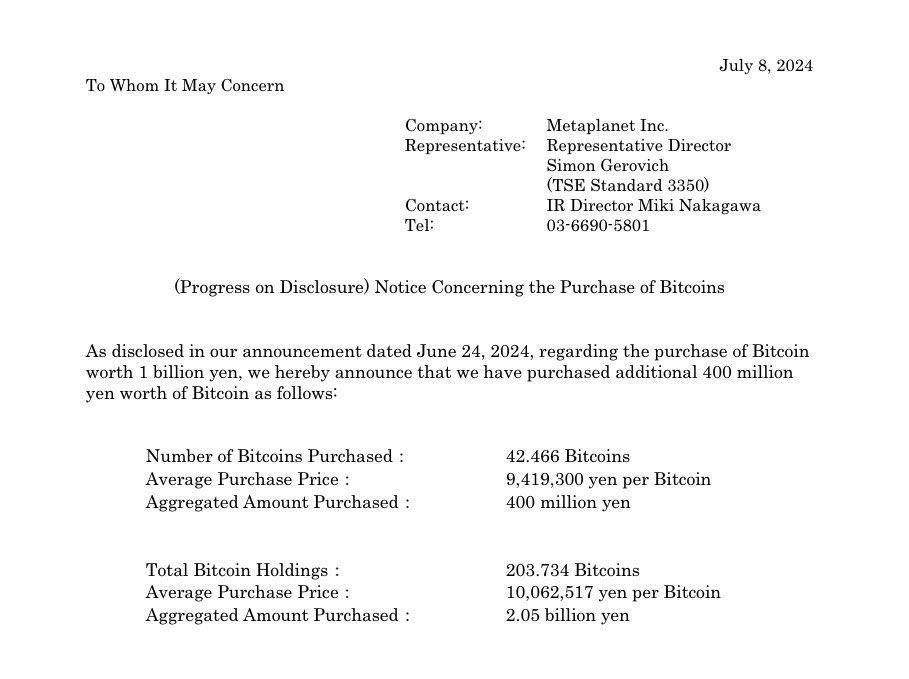

- Metaplanet Inc. bought 42 BTC worth about $2.4 million.

- The company now owns 203 BTC.

Amidst a very volatile market, the publicly traded company in Japan, Metaplanet Inc. has just bought over 42 BTC valued at approximately $2.4 million at current prices.

The firm’s move defies the crypto market sentiment amidst selling pressure from major companies.

The Tokyo-based company is part of a continuous move to bolster its digital assets and it brought the company’s total BTC holdings to almost 204 BTC, according to a public disclosure statement that was released on July 7.

In June, the company established a wholly-owned subsidiary called Metaplanet Capital Limited, as part of its strategic initiative to boost its Bitcoin holdings and capitalize on the latest international growth opportunities.

According to the company’s manifesto, Metaplanet will use the excess cash flow and implement accretive corporate governance, including financial management strategies such as debt and equity financing to enhance its BTC accumulation.

The company’s latest purchase comes at a time when Japan is struggling with decades-long economic challenges.

According to the latest reports, the yen’s exchange rate has steadily declined and it dropped to 160.96 against the US dollar and 173.81 against the Euro.

This is the yen’s weakest level against the dollar since back in 1986 and the lowest value against the euro on record.

Japan is currently facing prolonged economic stagnation, an aging population, and a shrinking workforce, exacerbating the challenges of the country.

About Metaplanet

Metaplanet boasts over a decade of diversified business engagement. The firm has deep roots in Japan, and the dynamic team comprises seasoned professionals with expertise in finance, trading, real estate, and Bitcoin as well.

According to its official website, Metaplanet responded to the pandemic-induced investment landscape with a new restructuring of its diverse assets and businesses. The firm is paving the way for a strategic pivot towards a Bitcoin-centric vision.