Summary

- Bitcoin whale and shark wallets are increasing this month amidst small trader selling.

- BTC whales are accumulating at their fastest pace since April 2023.

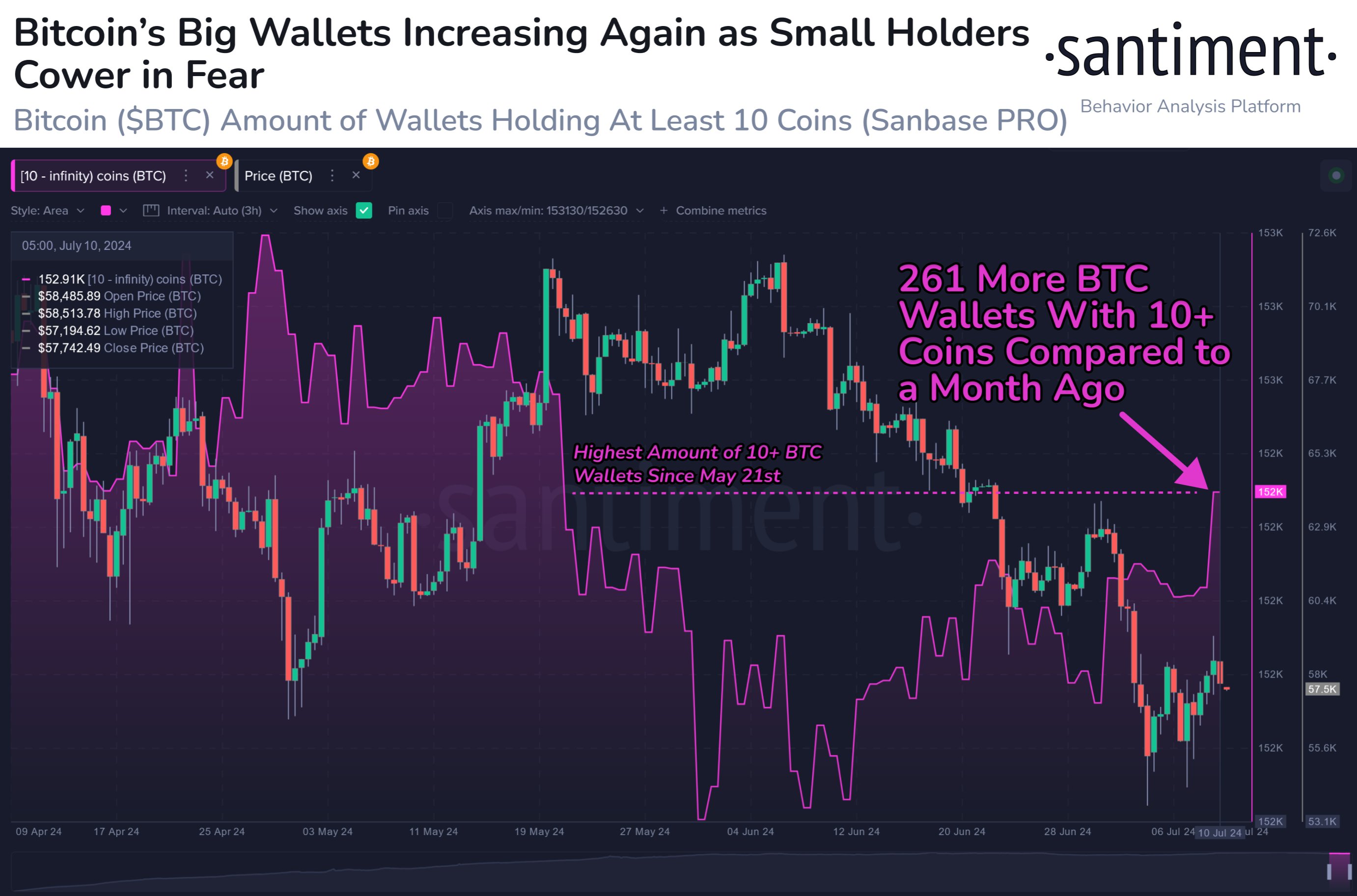

Bitcoin whale and shark wallets are increasing in number, according to the latest reports from Santiment.

In a post on X, the market intelligence platform shared a post revealing that wallets with at least 10 BTC are increasing this month, amidst small traders selling their bags during this dip period.

According to their notes, July has seen an increase of 261 new wallets that are now holding over 10 BTC. This should give traders comfort in a long-term bullish future, Santiment notes.

BTC Whales Are Accumulating at the Fastest Rate Since April 2023

Also, new reports from CryptoQuant revealed that BTC whales are now accumulating coins at the fastest rate in over a year.

According to them, whales have been increasing their holdings at a monthly growth rate of 6.3%, which is the fastest pace since April 2023. This shows a rising demand for Bitcoin, analysts highlighted.

CryptoQuant’s new report revealed that the increase in BTC demand from long-term holders is a good support for the price of Bitcoin which has recently seen increased volatility due to multiple factors.

These include the multiple sell-offs from the German Government, along with Mt. Gox repayments to creditors.

According to their report, Bitcoin‘s price dropped from a high of around $71,000 to the current range.

At the moment of writing this article, BTC is trading near $58,000, down by 2% in the past 24 hours.

However, the same report noted that the USDT market capitalization is still slowing down, and BTC prices usually rally as more liquidity enters the market via USDT minting. This is a condition that has not been met yet, analysts say.

It’s also worth noting that amidst this current price dip for Bitcoin, ETFs continue their buying spree.

Bitcoin ETFs Record 4th Consecutive Day of Inflows

Yesterday, July 10 marked the 4th consecutive inflow day for Bitcoin ETFs in the US, totaling over $147 million.

Fidelity’s Bitcoin ETF, FBTC saw the most significant inflow amount – almost $58 million, followed by Franklin Templeton’s Bitcoin ETF, EZBC which recorded over $31 million in inflows the other day.

BlackRock’s Bitcoin ETF, IBIT, saw inflows of $22.2 million.

Grayscale’s Bitcoin ETF, GBTC, was the only crypto product that saw outflows of over $8 million, according to data from SoSoValue.