Summary

- The Global M2 supply could kick off a rally at the end of next month that could last two months.

- More significant capital could flow into the BTC market.

The Global M2 is on the rise, and new predictions claim that it could debut a significant blast-off sometime at the end of next month. This translates into more capital flowing into Bitcoin and the crypto markets.

M2 Global Supply on the Rise

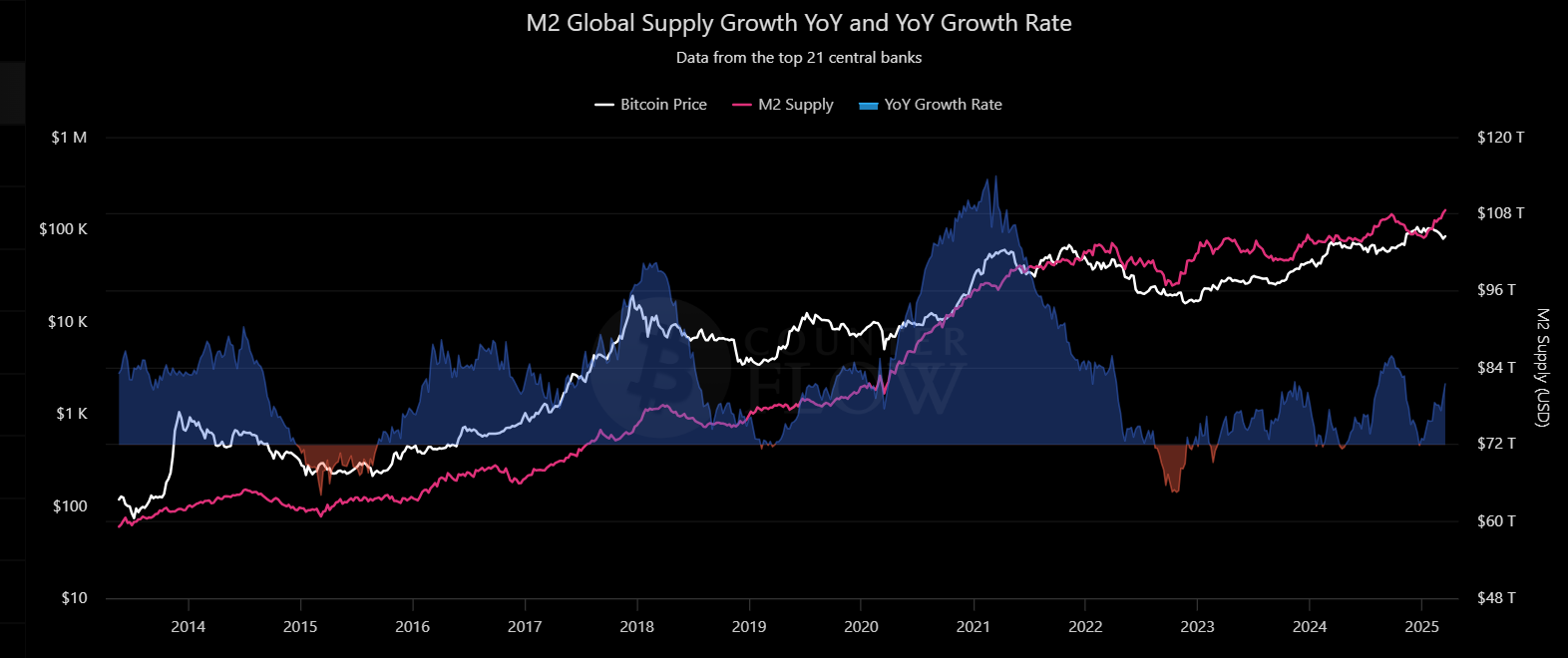

Official data from Bitcoin Counter Flow shows that as of March 17, the M2 global supply was above $109 trillion, with a YoY growth rate of over 4.7%.

The global M2 money supply represents the total amount of liquid money circulating in the economy, and this is a good metric for predicting how capital flows into Bitcoin and crypto markets.

Technical analysis predicts that Bitcoin’s price action against the global money supply points to a big upcoming move, according to The M2 Guy’s predictions via X.

M2 Blast Off Could Come Around April 30

The analyst shared a bullish prediction via X, highlighting that thr global M2 could start a notable rally around the end of next month, according to a 107-day offset for M2 which has a mathematical correlation.

He says that the rally could last for around two months, based on how long the M2 line goes vertical, and it could extend even more if the M2 continues to go up.

He concluded by saying that regardless of this blast-off timing accuracy, a massive influx of global M2 is coming which translates into bullish moves for the BTC market.

Global M2 vs BTC update

I still think this is the most likely scenario. Note that doesn’t mean it’s the only scenario.

🔹 Blast-off date around APRIL 30, using a 107-day offset for Global M2. (has a high mathematical correlation)

🔹 Rally could last for 2 MONTHS, based on how… pic.twitter.com/0eCibsD79n— The M2 Guy (@ColinTCrypto) March 21, 2025

Today, Bitcoin is trading above $84,000 following a volatile week.

Bitcoin Holds Above $84,000

Following a price drop to $83,000 levels on March 21, today BTC is up by over 0.2%.

Predictions for the most important digital asset remain optimistic, especially following the latest FOMC meeting during which the US Fed hinted at an upcoming quantitative easing starting in April, and other bullish triggers including Trump’s huge support for the industry, and upcoming clearer regulation that will boost investor trust.

Also, institutional interest in Bitcoin remains on the rise, with the US BTC ETFs recording their sixth consecutive day of inflows on March 21 at $83 million according to data from SoSoValue.