Summary

- Metaplanet has joined the Bitcoin for Corporations initiative.

- This aims to boost Bitcoin adoption in Japan and globally.

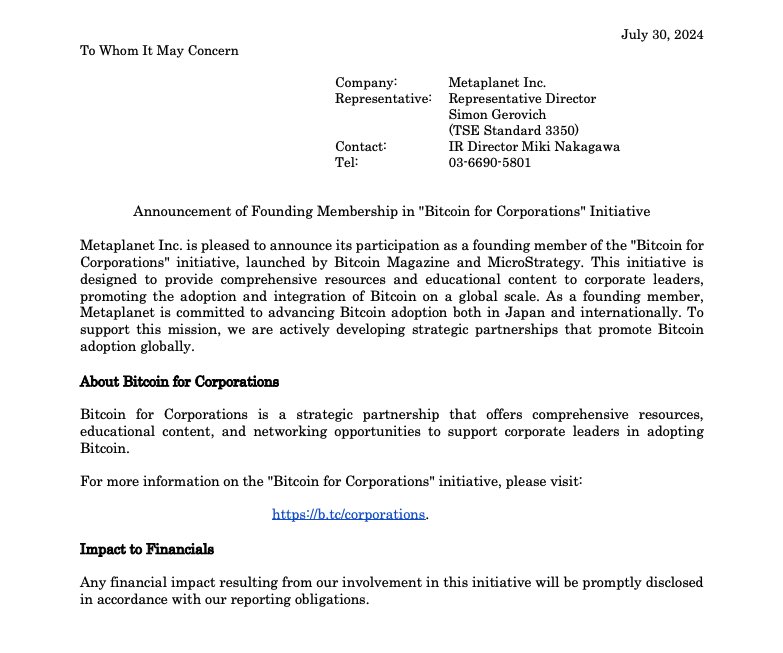

Today, July 30, Metaplanet released an official statement called Announcement of Founding Membership in the “Bitcoin for Corporations” Initiative.

In the announcement, Metaplanet revealed that it debuted its participation as a founding member of the “Bitcoin for Corporations” initiative launched by MicroStrategy and Bitcoin Magazine.

This is an initiative designed to provide comprehensive resources and educational content to corporate leaders, promoting the adoption and integration of Bitcoin on a global scale.

According to the same notes Metaplanet is committed to advancing Bitcoin adoption both in Japan and globally. In order to support this mission, the company is actively developing strategic partnerships that promote Bitcoin adoption globally.

Metaplanet Finalized Bitcoin Purchase Plans

Earlier this month, Metaplanet has finalized its Bitcoin buying plans. According to reports, the Japanese investment firm has bought over 20 BTC worth around $1.2 million at buying prices dating July 22.

The firm released an official announcement, revealing that the average purchase price was around 9,8 million yen per coin.

In June, Metaplanet revealed its 1 billion yen purchase plans, and on June 24, the firm said that it would issue bonds to raise money to buy Bitcoin.

The firm also revealed its basic policy of holding Bitcoin for the long term.

Back in April Metaplanet said that it would embrace Bitcoin as a core treasury asset. The company said that it was initially committing $6.5 million to buy BTC, and said that the move was a milestone in its goal to position itself as a pioneer in the adoption of digital assets in Japan.

Japan’s Metaplanet has been compared to the US company MicroStrategy. This is due to the similar decision to adopt Bitcoin for long-term holding. Metaplanet’s move was a direct response to the sustained economic pressure in Japan.