Summary

- MicroStrategy bought $1.1 billion worth of Bitcoin between August 6 and September 12.

- Now, the firm holds over $14 billion in BTC.

According to the latest reports, MicroStrategy bought 18,300 Bitcoins worth about $1.11 billion, according to the latest reports from Bloomberg.

This is the largest BTC purchase that the crypto hedge fund proxy made in more than three years, the same reports note.

MicroStrategy Owns 1% Of All Bitcoin Issued

Bloomberg cites data from the US SEC released today and notes that the company, which has a corporate strategy of buying Bitcoin, bought the digital asset between August 6 and September 12.

This is reportedly the largest amount of BTC that the company bought since its 2021 acquisition in February when they acquired 19,452 BTC.

According to the latest reports cited by the same online publication, MicroStrategy now holds around 244,800 Bitcoins valued at over $14.6 billion at current prices.

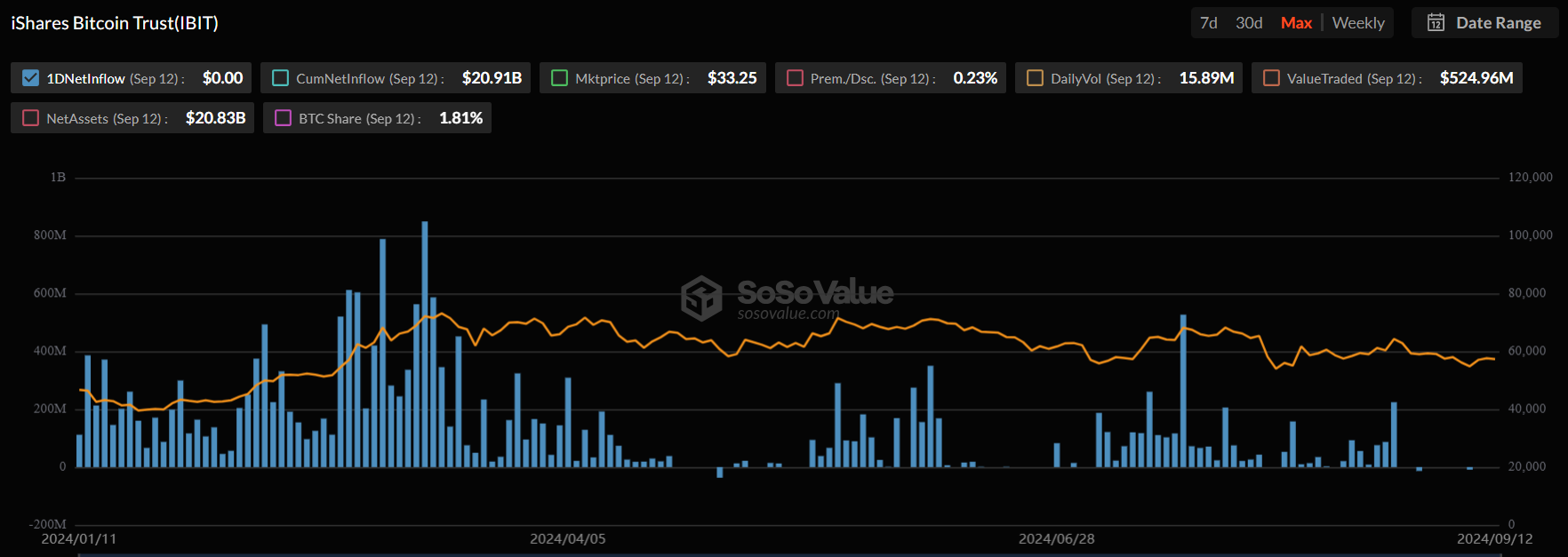

Bloomberg noted that this is about 1% of all the Bitcoin that was ever issued, highlighting that now, BlackRock’s Bitcoin ETF, IBIT, is the world’s largest Bitcoin fund at around $20 billion.

Data from SoSoValue shows that IBIT had $20.8 billion in total net assets locked as of September 12.

According to official data, MicroStrategy bought its tokens at an aggregate purchase price of about $9.45 billion and an average purchase price of about $38,585.

Strong Belief in Bitcoin

MicroStrategy’s investment strategy continues to reflect its belief in Bitcoin’s role as a reliable store of value. The company’s consistent accumulation of BTC over the past years highlights its confidence in the digital asset’s long-term potential.

By now, MicroStrategy’s investment in Bitcoin has appreciated by about 56%, which translates to an unrealized gain of $4.7 billion.

Over the past 5 years, since it adopted the Bitcoin buying strategy, the company has seen massive growth and it’s one of the top gainers among the S&P 500 stocks with an 860% increase.

The company has been prasied and also criticized for its Bitcoin buying strategy.

While critics caution about the risks associated with such concentrated exposure to a single highly volatile asset, proponents argue that its move has not only provided significant returns but also increased institutional acceptance of Bitcoin as a legitimate financial asset.