Summary

- The founder of MN Capital believes Bitcoin could reach $110,000 in the next rally.

- BTC is trading at $65,000.

The founder of MN Capital Michael vad de Poppe sees Bitcoin reaching prices of $110,000 on its next major rally, despite concerns regarding lower highs and lower lows forming as a pattern on the BTC price chart.

In a recent post via X, he wrote that the next leg is likely to bring BTC to the price mentioned above.

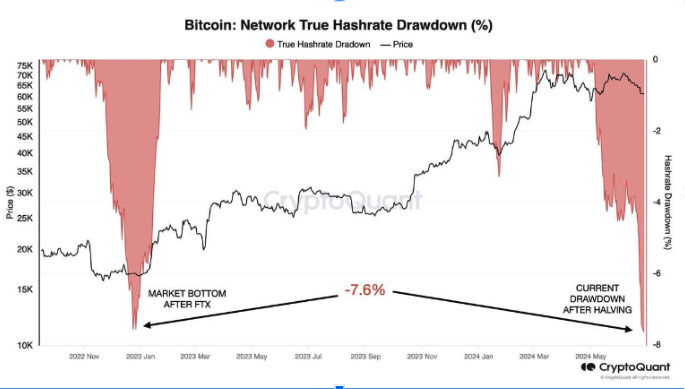

He also shared a chart featuring the Bitcoin network hashrate drawdown, pointing out that at the bottom, Bitcoin miners are capitulating.

He wrote that the true hash rate drawdown at its last low on July 1 was as “heavy” as during the FTX collapse.

According to him, this marks a cycle low, and since the news involving Mt. Gox beginning repayments to creditors, the price of BTC has rallied by 20%.

CryptoQuant revealed that Mt. Gox FUD is overestimated, which means that the repayments will not affect BTC’s price as much as initially believed.

Also, a few hours ago, veteran trader Peter Brandt wrote in a message via X that he is impressed by the current bounce in Bitcoin and it should be noted that the sequence of lower highs and lower lows continues despite the halving event, the ETFs, and the hype.

Bitcoin Price at $65,000

Regarding Bitcoin’s price today, at the moment of writing this article, BTC is trading at $65,000, down by 1% since the other day.

On July 17, BTC reached prices close to $66,000.

Institutional money continues flowing into Bitcoin ETFs following a longer period of outflows. Today, the crypto products recorded over $53 million in inflows, according to SoSoValue data, marking the 9th consecutive day of influxes in the US-based BTC ETFs.

BlackRock’s Bitcoin ETF, IBIT, recorded over $110 million in inflows on July 17 and Fidelity’s Bitcoin ETF, FBTC, saw almost $3 million in inflows.

Yesterday the crypto products marked the largest inflow day since early June with $422.6 million.