Summary

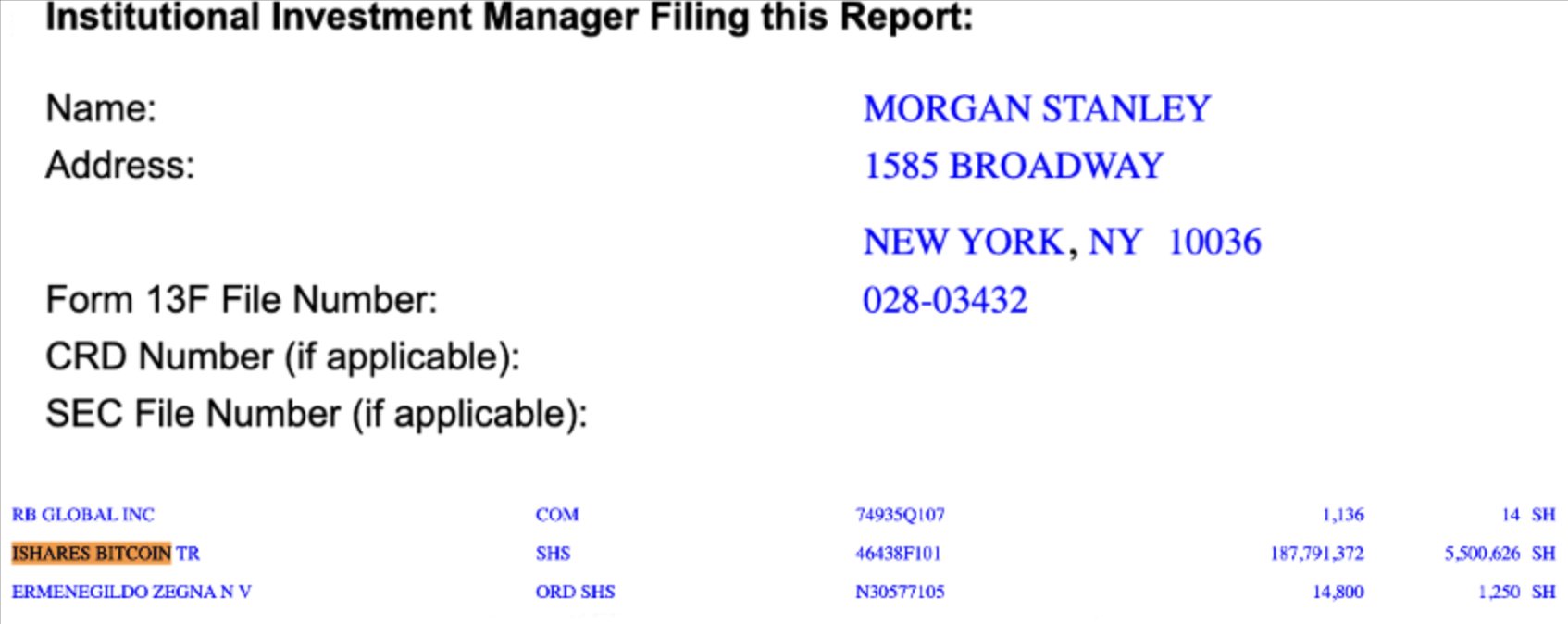

- Morgan Stanley disclosed positions in BlackRock’s Bitcoin ETF, IBIT.

- The company owned 5.5 million shares worth $188 million in IBIT as of June 30.

According to the latest reports, Morgan Stanley, disclosed its form 13F filing with the US SEC on August 14, showing significant positions in BlackRock’s Bitcoin ETF, IBIT.

As of June 30, the multinational investment bank and financial services company reported it had over 5.5 million shares worth about $188 million of the BlackRock Bitcoin ETF, IBIT.

Such numbers make Morgan Stanley a top five shareholder of the BlackRock BTC ETF.

According to official reports, the financial entity also disclosed that it owned 26,222 shares of the ARK 21Shares Bitcoin ETF, ARKB, worth about $1.57 million.

Their latest filing showed a position that totaled around $148,000 in the Grayscale Bitcoin Trust, GBTC.

13F filings are quarterly reports that are filed with the US SEC by institutional investment managers who have at least $100 million in equity assets under management.

These filings offer a view of the manager’s stock holdings at the end of each yearly quarter, although they do not disclose any short positions.

Morgan Stanley’s announcement comes following another important disclosure about significant companies that have shares in Bitcoin ETFs.

Goldman Sachs Disclosed Fund Shares in BTC ETFs

Not too long ago, Goldman Sachs also disclosed fund shares in US-based Bitcoin ETFs, worth about $418 million as of June 30.

The multinational financial services company also filed a 13F with the US SEC revealing positions in the crypto products.

Goldman Sachs revealed the following positions in Bitcoin ETFs in the US as of June 30:

- $238.6 million in BlackRock’s Bitcoin ETF, iShares Bitcoin Trust, IBIT (6,991,248 shares)

- $79.5 million in Fidelity’s Bitcoin ETF, FBTC (1,516,302 shares)

- $35.1 million in Grayscale’s Bitcoin ETF, BTC (660,183 shares)

- $56.1 million in Invesco Galaxy’s Bitcoin ETF, BTCO (940,443 shares)

- $8.3 million Bitwise’s Bitcoin ETF, BITB (253,961 shares)

- $749,469 WisdomTree’s Bitcoin ETF, BTCW (11,773 shares)

- $299,900 ARK 21Shares’s Bitcoin ETF, ARKB (5,000 shares)

Apart from Goldman Sachs and Morgan Stanley’s latest important positions disclosures, the London-based hedge fund Capula Investment also reported significant investments in BlackRock’s and Fidelity’s Bitcoin ETFs at the beginning of August.

According to their notes, the hedge fund invested around $500 million in the two Bitcoin ETFs mentioned above.

The huge wave of institutional investments in Bitcoin ETFs reveals the rising interest in Bitcoin and related crypto products.