Summary

- Mt. Gox repaid users continue hodling their Bitcoin, CryptoQuant notes.

- BTC’s dip below $65,000 is reportedly due to seasonal, and political reasons.

Mt. Gox repaid users are reportedly holding their coins, according to new reports from CryptoQuant.

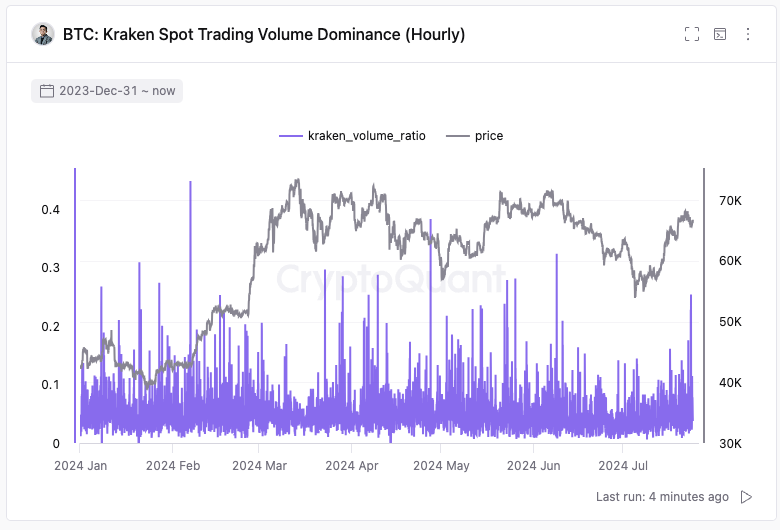

In a post on X, the founder and CEO of CryptoQuant, Ki Young Ju, noted that after the Mt. Gox creditors’ repayments, all global time zones have passed. Kraken’s spot Bitcoin trading volumes and exchange flows are normal, he wrote on July 24.

According to his X post, the instant dump that everyone was worried about did not occur. Any price drop would be likely due to market sentiment, and not Mt. Gox selling.

CryptoQuant also cited notes from Onchainschool saying that there was a significant increase in BTC withdrawals from Kraken after the affected Mt. Gox users started receiving their Bitcoin. This could reportedly be a positive signal, indicating that they are not selling and are preparing to hold their coins.

Users are reportedly moving their coins from the exchange to cold wallets, according to the same notes.

On July 24, Ki Young Ju posted that Bitcoin is now in an accumulation phase. According to him, over the past month, 358,000 BTC has moved to permanent holder addresses. In July, the global spot ETF inflows were 53,000 BTC.

He said that though not all remaining BTC is in custody wallets, whales are clearly accumulating at unprecedented levels.

Bitcoin’s Dip Below $65,000 Is Not Due to Mt. Gox Moves

Crypto analysts are saying that Bitcoin’s price drop below $65,000 is not due to Mt. Gox fund repayments to creditors. They claim that the drop in price for Bitcoin comes from a decline in market sentiment, and seasonal trends rather than the moves of the defunct exchange.

At the moment of writing this article, BTC is trading above $64,000.

Capriole Investments founder Charles Edwards said in a post on X that the recent launch of Ethereum ETFs on July 23 might also be affecting market sentiment.

According to him, there is a good chance that this launch will turn the ship around, but the whole market would have been better if the ETH ETFs’ launch was not in 2024.