Summary

- Mt. Gox announced today the debut of BTC and BCH repayments to creditors.

- Waiting times will vary up to three months, depending on exchanges.

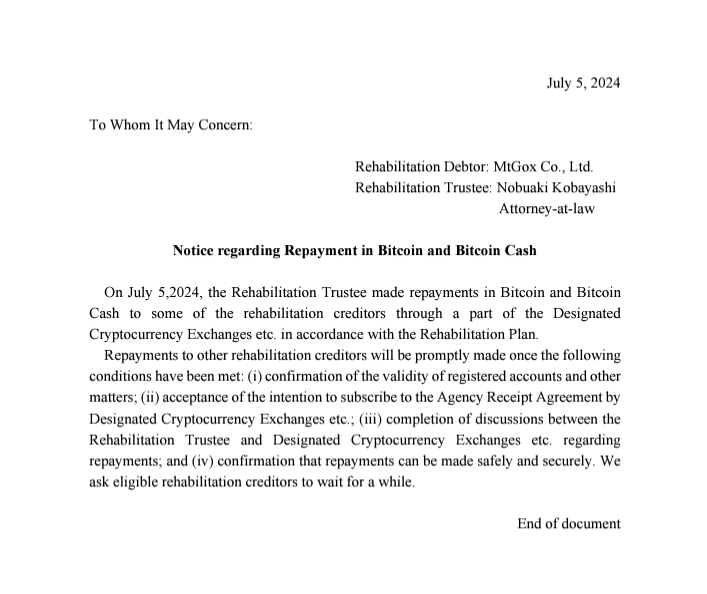

Earlier today, Mt. Gox, the defunct Japanese crypto exchange launched in 2010, announced the beginning of Bitcoin and Bitcoin Cash repayments for creditors.

In an official announcement, the Rehabilitation Trustee stated that it made repayments to some of the rehabilitation creditors via a part of the designed crypto exchanges.

According to their Rehabilitation Plan, there are a few conditions that have to be met by the credits in order to receive their payments. These include the following, as per the official announcement:

- Confirming the validity of their registered accounts

- Accepting the intention to subscribe to the Agency Receipt Agreement by designated crypto exchanges

- Completing discussions between the Rehabilitation Trustee and the exchanges regarding repayments

- Confirming the safety and security of repayments

Waiting Times Up to 3 Months

According to the latest reports, Mt. Gox creditors could wait for a time period of up to three months in order to receive their Bitcoin and Bitcoin Cash repayments.

The waiting time will vary according to the exchanges involved as follows:

- Kraken crypto exchange has 90 days to process the payouts.

- Bitstamp exchange could take up to 60 days.

- BitGo will provide visible payouts within 20 days.

- SBI VC Trade and Bitbank, both will have 14 days to process payouts.

In the official notes, the Trustee said that each crypto exchange is obligated to add the number of BTC and BCH to the balance of the creditor’s account within the specified amount of days after the digital assets are transferred from the Rehabilitation Trustee.

In June, Mt. Gox announced that it would begin the repayment process involving the distribution of about $9 billion worth of BTC, BCH, and fiat in July.

In February 2014, the exchange suspended trading, and closed its website and the exchange service, filing for bankruptcy protection from creditors. In April of the same year, the company began liquidation proceedings.