Summary

- BTC ETFs continue their inflow streak, with BlackRock’s IBIT as leader.

- BTC is trading at $67,000.

The US-based Bitcoin ETFs continued their inflow streak for the fourth day this week.

On October 25, BTC ETFs recorded over $402 million in inflows and the cumulative net inflow in the crypto products is close to $22 billion since their January launch.

In-Depth Details About Bitcoin ETF Inflows Yesterday

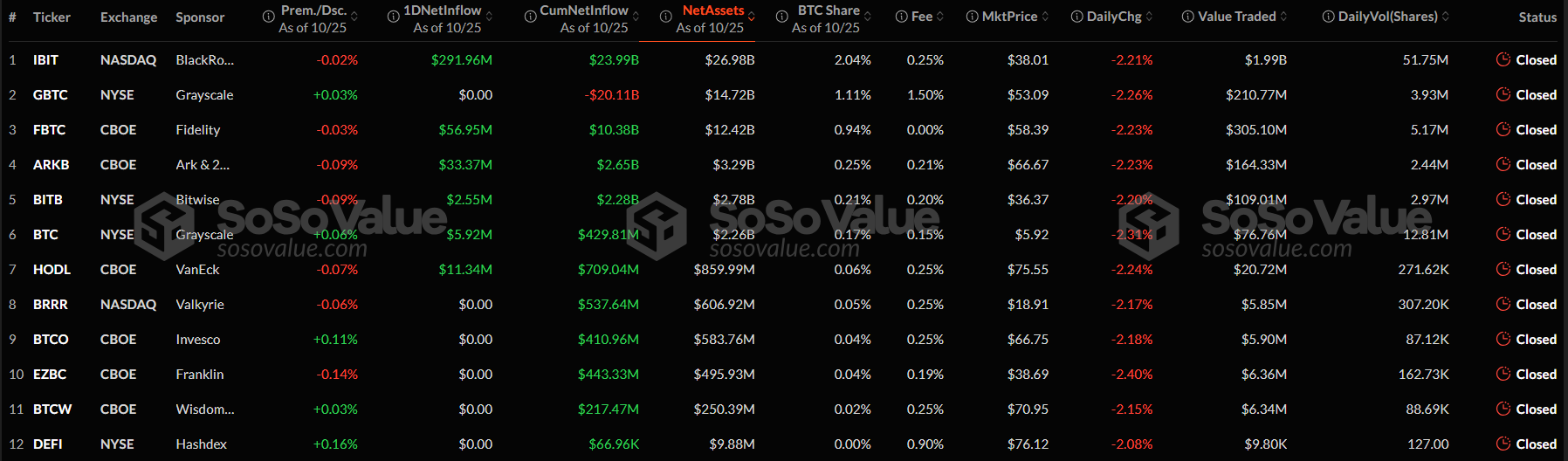

The US Bitcoin ETFs recorded only influxes the other day as follows:

- BlackRock’s Bitcoin ETF, IBIT, was the leader with almost $292 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, saw almost $57 million in inflows.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, saw $33.3 million in inflows.

- Bitwise’s Bitcoin ETF, BITB, recorded $2.5 million in inflows.

- Grayscale’s Bitcoin ETF, BTC, saw almost $6 million in inflows.

- VanEck’s Bitcoin ETF, HODL, saw over $11 million in inflows.

None of the BTC ETFs in the US recorded any outflows the other day and the crypto products have surpassed $65.2 billion in total net assets locked, according to data from SoSoValue.

Since October 11, BTC ETFs in the US have seen consistent inflows apart from October 22, which marked the only outflow day at $79 million.

Economist Timothy Peterson, recently highlighted via X that BTC ETFs reached $20 billion for the first time.

As Bloomberg analysts recently noted, gold ETFs required around 5 years to reach this amount, but the crypto products in the US managed to hit the important level in under a year.

The latest buying spree recorded by the crypto products has been a catalyst for Bitcoin’s price which recorded significant rallies during the past two weeks.

Bitcoin Price Trades Above $67,000

At the moment of writing this article, BTC is trading above $67,000, after dipping earlier to $65,000 levels, ahead of a quick rebound.

On October 25, BTC’s price neared the important level of $69,000 once more. On October 21, BTC managed to break the important level, trading close to $69,400.

Other important price catalysts of the week were whale accumulation, institutional investors, and the upcoming US elections, along with other optimistic achievements including Pennsylvania passing a Bitcoin Rights bill, which protects crypto users’ self-custody rights and brings enhanced regulation.

The elections are scheduled for November 5, and the markets saw intense volatility in the weeks ahead. However, analysts see a potential price target for Bitcoin of $100,000 by February, regardless of the election results.