Summary

- Bitcoin price dropped to $57,000, down by over 4% today.

- New data shows steady selling from spot markets.

- Long-term BTC holders see high profits.

Bitcoin saw a sharp decline in price today, close to the $57,000 level. At the moment of writing this article, the coin recorded a bounce to around $57,700. Still, BTC is now over 4% down in the past 24 hours.

- Zoom

- Type

Data from TradingView caught new local lows of around $57,000 on Bitstamp after the latest daily close.

Steady selling from spot markets and a lack of sentiment are cited as unfavorable conditions for Bitcoin bulls.

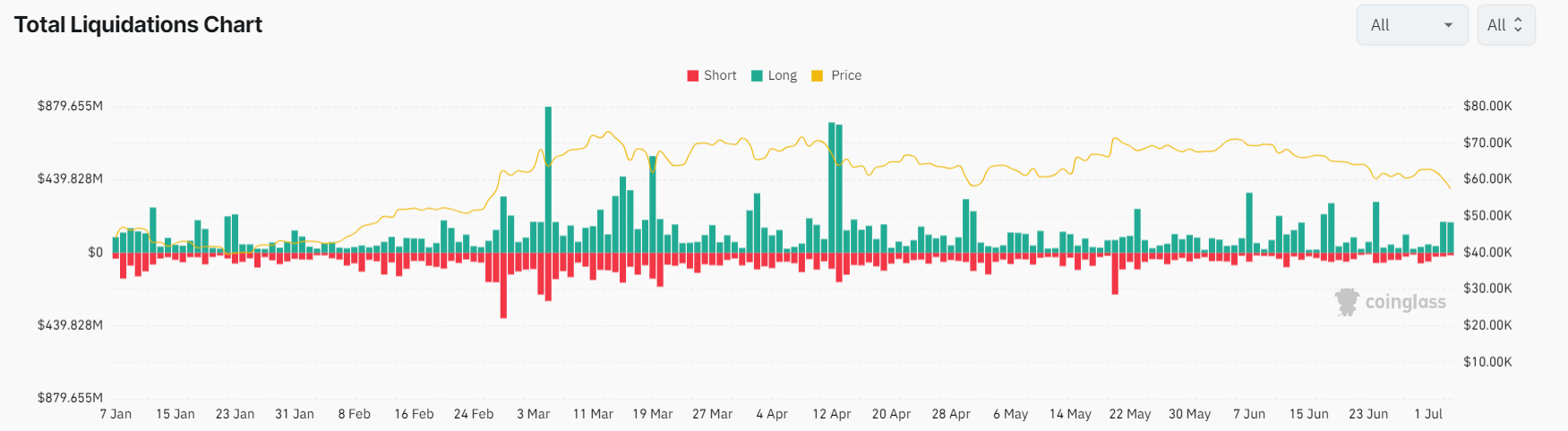

Data from CoinGlass shows around $100 million BTC liquidations in the past 24 hours, from which $86 million in long liquidations and $14 million in short.

Long-Term BTC Holders Realize Significant Profits

In a new post on X, CryptoQuant shared that long-term Bitcoin holders are realizing important profits, contributing to the price decline.

According to the notes, the highest activity was observed among holders who had kept their BTC for about 5-7 years.

CryptoQuant cited info from IT Tech on-chain data analyst and revealed that last evening on July 3, the SOPR (Spent Output Profit Ratio) for long-term BTC holders indicated values above 10 which suggested that the coins were moves on the blockchain with substantial profits.

A high SOPR correlates with a price correction, implying that long-term investors have realized profits over 10 times their initial investment.

Also, the Spent Output Age Bands chart revealed the age categories of the moved coins. According to the data, the highest activity was observed among holders who had kept their Bitcoin for 5 to 7 years.

A Different Cycle

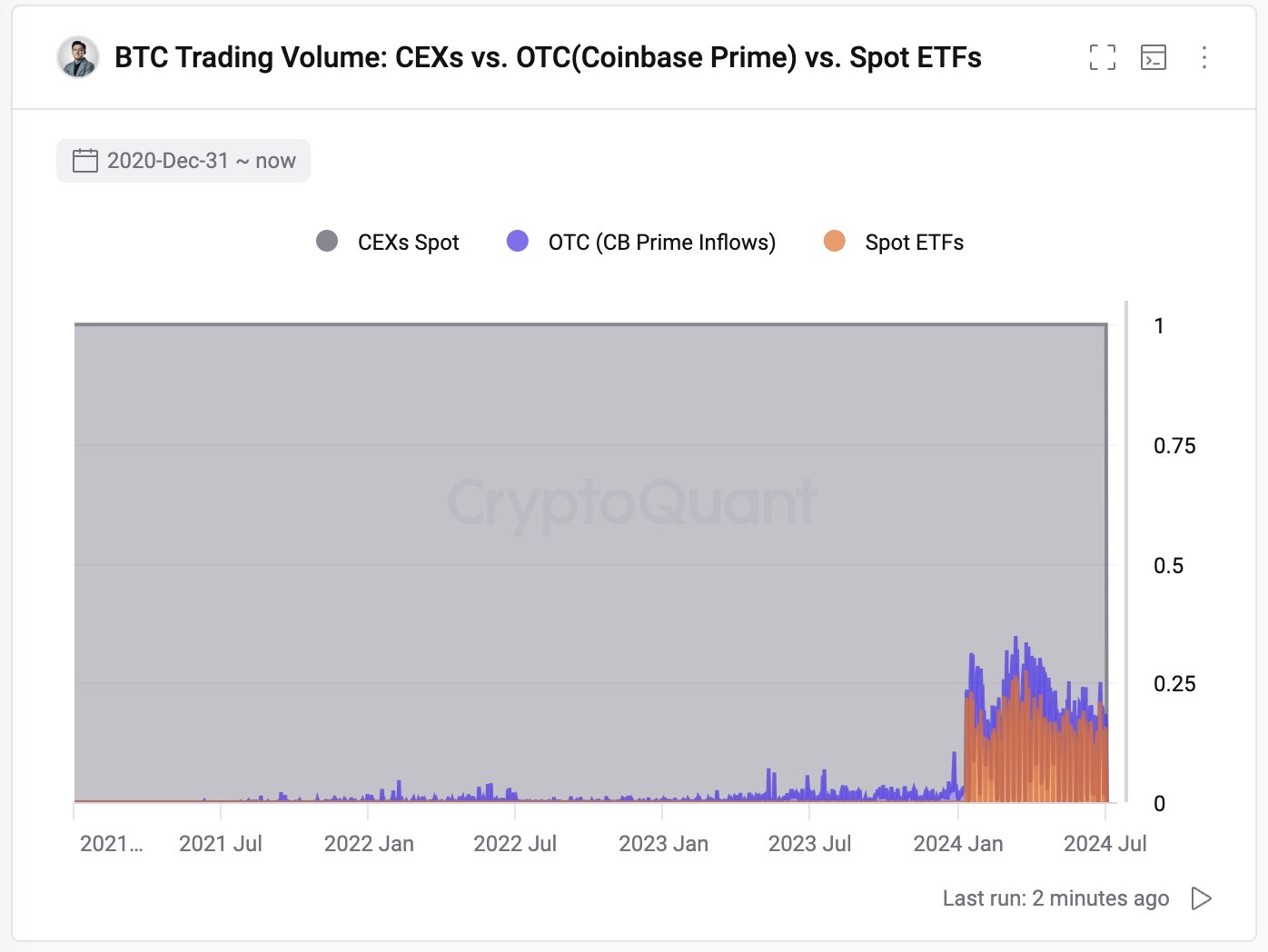

On July 3, CryptoQuant CEO, Ki Young Ju noted in another post on X that this cycle is different and the source of money is different as well.

He noted that BTC ETFs now make up a quarter of total spot trading volume. New money this time is more mature than ever according to him, and he believes that there’s still much more mature money to come.

He also highlighted that mature money usually has diamond hands.

He also highlighted that the market is maturing, which means that it’s not already mature, and there is still a lot of institutional capital waiting to enter the space.